May 12, 2017

This Podcast Is Episode Number 0216 And It Will Be About Unique High-Profit Contractors Count All Their Income

The Ripple Effect Of Not Counting All Your Income Happens When You Go To The Bank For A Loan

You need to be able to show the bank that you have enough sales to pay back the loan. For most contractors, an excessive amount of profit is NOT an issue.

There are always more than enough expenses that happen naturally

in your Construction Company. And there are always tools that

need to be purchased, repaired or replaced.

As 2017 tax season is finishing, I have heard from owners and

employees who say. This Income or That Income doesn’t count. The

fact is it all Counts.

The underground economy may be there but don’t count on the

information being a secret. Between Memberships, rewards cards and

using a credit card purchases are being tracked everywhere by

somebody. (Some contractors think buying a truck for cash is not

traceable).

Play it straight, report all of your construction company income and if your QuickBooks setup is done right and the bookkeeping entries are clean more often than not you may get a big fat tax refund!

Merchant Service providers are required to issue 1099’s

This means every time you use a debit or credit card the amount, date, place of purchase is recorded and the grand total for the year is reported to the IRS.

Web-based services (E-Bay) are required to issue 1099’s is earning are over a certain amount. Casino’s issue 1099’s is winnings are over a certain amount. Construction Company Owner’s issue 1099’s and finally there is a Nanny Tax on household help.

Tax Reporting Is Everywhere You Win When You “Play Within The Rules” This Means Don't Cheat Your Own Future, Count All Of Your Income

Keep track of all your expenses. Have a good bookkeeping system to calculate the difference between Profit And Loss. Invest is good tools and equipment. Depreciate the high-value items like cars, trucks, vans, tools, equipment and expensive software.

We have found that a Professional Version of Construction Accounting software

like QuickBooks and Professional cloud-based services have additional

value to be worth more than the “Cheap Price” of something less.

This does not mean that all expensive software and apps are the

Perfect choices based on a High Price – if it is useful, then it

may be the “Better Value.”

A tiny pickup truck based on price is cheap. But if you need an 8’

bed and are hauling lots of “Heavy Things” than it is cheap but not

the best value as a ¾ Ton or 1-Ton Truck would be.

Contractors at all stages of their Construction Company have to be

price and value conscience. It may be a shock to some, but cash

flow issues happen to everyone at some stage in their Construction

Company. All it takes is for a few customers with “large invoices”

outstanding to delay payments for a long time, and you are

experiencing a “Cash Crunch.”

Unsigned or forgotten Change

Orders can also be a problem. Forget the customer

who promises “If you give them a good price on this project – they

have several more jobs waiting for you.” (so that you can lose even

more money).Click Here to download our FREE Change Order Form

on PDF.

The challenge for all contractors is How Much to charge for their product and services to make a profit.

Picking a Price Point that is fair to both parties. The goal is to always Provide Good Quality Work. Frustration comes when the person they are working for wants to “Nik Them A Little,” then “A Little More” and still expect that The Contractor to be a willing rush to their project, eager to put in another day and do even more “Extras For Free” - Answer is Usually Not!

Give Good Value

Many new contractors provide “Handyman

Services” a low cost to get the additional experience and to show

they have clients. Helping The Grandmother down the street and all

her friends. This is different from working for a Builder /

Developer and discovering they built the house for practically

“free.”

If you are required to Collect Sales Tax – be sure to have it

spelled out in the contract as Plus Sales Tax after the subtotal.

Almost everywhere in Washington State sales tax is 10%. Just

missing a little thing like charging the Sales Tax (repeatedly)

could be the difference between a profitable year or having a

loss.

Think about the benefits of Flat Rate, Bid Jobs and Time and

Material Billing. I know of contractors who refuse to Mark Up

Material and do not charge labor to go get the material. If The

Contractor’s Labor Rate is high enough this might not be a problem.

Many times, when the customer does not want to pay a markup – they

also are also looking for ways to complain about the price of

material and try to deduct some hours from the invoice. After all –

how cool is FREE?

A couple of years ago, I had

a Homeowner come to my office

The Homeowner was very up front that

she was trying to figure out a way to not pay the contractor the

final invoice. The Homeowner was certain that there must be a way

to find a massive discount and avoid paying the final bill.

Because we do Construction Accounting, the Homeowner wanted my help

to review all the invoices to find anything that would allow

deductions. She was very unhappy the work passed inspections, and

the Permits were all written off.

Contractors need to write clear estimates, contracts, be sure to send Notice To Owners to protect their Lien Rights.

We like Zlien The Mechanics Lien & Construction Payment Platform for contractors because:

- They know when document are due for projects

- They research documents and sends notices on time

- They receive, manage, and sends your lien waivers

- They produce legally compliant forms every time

Click Here To Learn About Zlien The Mechanics Lien & Construction Payment Platform for contractors

Keep your invoices simple, collect the

money. Take Credit Cards from the mainstream processor. Discount

for cash if it makes sense. Get Paid - Move On. Count All The Money

as Income.

A customer’s tip is $20.00 – Even that is Other income on an

invoice. It’s the habit. And Good Habit’s will be better for you in

the long run. Our parents and grandparents had many “Old Fashioned

Saying.”

When you think about it – Their sayings usually made sense without

being offensive or overbearing while saying them.

My Father’s favorite saying

was “Tend To Your Knitting” meaning “Keep Focused – Don’t Get

Distracted.”

My Brother’s is “Don’t Stop” he lives in the country, and they tend

to move “Big Things” down a narrow road. For a Contractor in the

city, it would mean “If it’s working – keep doing it” (Think

Marketing)

It annoyed our children when Randal and I would speak in shorthand

referencing a movie or a book.

Now that they are older – they “Get The Humor” and “The Lesson.”

For most of us, our parents and grandparents got smarter the older

we got. They let us spread our wings and tried new things. Being a

Contractor is like that. Having an idea, a dream and willing to “Go

For It” (with the support of others)

There is no book with the perfect answers to all the “What If” and

“What About Questions” What makes a good client for one contractor

is not necessarily a good client for another. The same is for

employees. Not all people are a “Good Fit.” for your construction

contracting company.

Every Contractor will need and want a new(er) truck at some point.

Bankers like to see Good, Clean Financial Statements. You may know

all of your numbers in your head. It is hard to tell a Banker you

make a lot of money and can support the loan if all your statement

shows are $10,000 in sales for the year.

Written on a piece of notebook paper it is not as believable as

coming from QuickBooks, and your sales are much higher, and your

net income is $10,000.00. The banker can look at “Why” and see if

the numbers can be moved around to make sense. The Banker may need

to Explain Your Numbers To A Loan Committee who does not know you.

Many Bankers really do want to “Say Yes” and give you the loan.

We Can Help “A Little” or “A Lot” Depending on your needs.

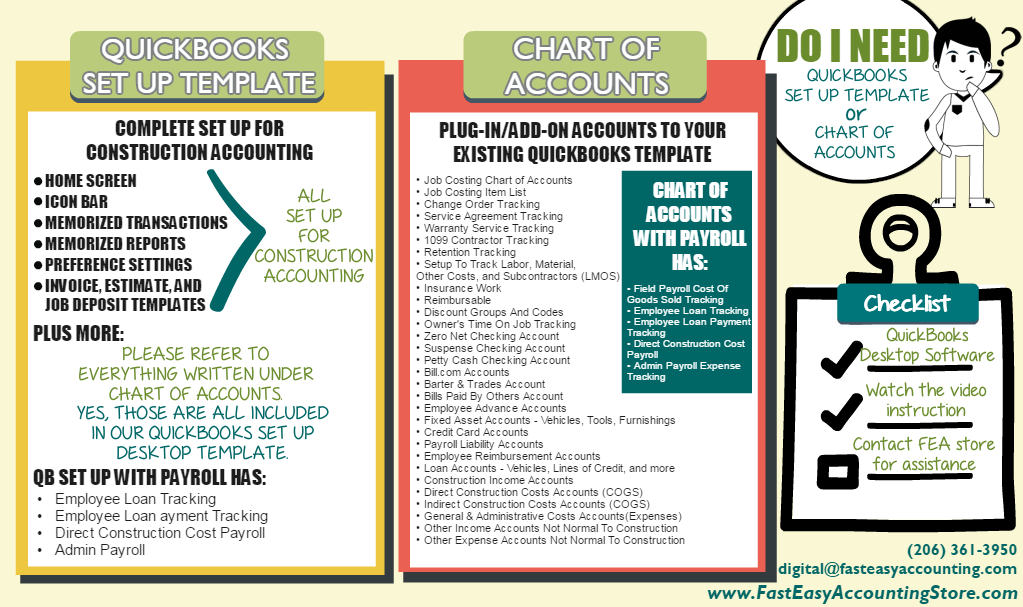

We work with QuickBooks Desktop Version for Setup, QuickBooks

Cleanup, and Provide Ongoing Contractor Bookkeeping Services, and

Contractor Consulting Services.

Looking forward to chatting about your

specific needs.

PS:

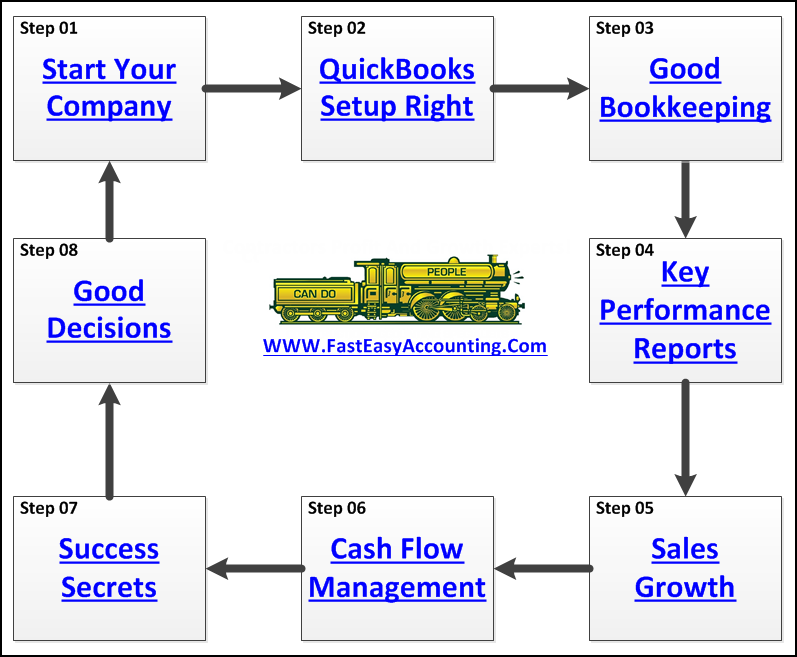

After we setup QuickBooks for your specific construction company you have a range of options:

- Do-It-Yourself Bookkeeping

- Utilize our Outsourced Accounting Services.

- Keep your QuickBooks file on the Server and do your own bookkeeping (our QuickBooks setup is not required)

- Buy QuickBooks Chart of Accounts and/or QuickBooks Setup Templates for the “Do-It-Yourself” Contractor at the FastEasyAccountingStore.com

Wishing you the Best

Enjoy your day.

Sharie

About The Author:

![]()

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

I trust this podcast helps you understand that outsourcing your contractor's bookkeeping services to us is about more than just “doing the bookkeeping”; it is about taking a holistic approach to your entire construction company and helping support you as a contractor and as a person.

We Remove Contractor's Unique Paperwork Frustrations

We understand the good, bad and the ugly about owning and operating construction companies because we have had several of them and we sincerely care about you and your construction company!

That is all I have for now, and if you have listened to this far please do me the honor of commenting and rating podcast www.FastEasyAccounting.com/podcast Tell me what you liked, did not like, tell it as you see it because your feedback is crucial and I thank you in advance.

You Deserve To Be Wealthy Because You Bring Value To Other People's Lives!

I trust this will be of value to you and your feedback is always welcome at www.FastEasyAccounting.com/podcast

One more example of how Fast Easy Accounting is helping construction company owners across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to construction contractors like you so stop missing out and call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

Contractor Bookkeeping Done For You!

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Link Below:

This guide will help you learn what to look for in outsourced construction accounting.

Need Help Now?

Call Sharie 206-361-3950

Thank you very much, and I hope you understand we do care about

you and all contractors regardless of whether or not you ever hire

our services.

Bye for now until our next episode here on the Contractors Success

MAP Podcast.

Warm Regards,

Randal DeHart | The Contractors Accountant

Our Workflow Removes Your Paperwork Frustrations

For Contractors Who Prefer

To Do Your Bookkeeping

Fast Easy Accounting

Do-It-Yourself

Construction Accounting Store Is

Open

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Short List Construction Contractors We Serve

Brand New Construction Company Handyman Company

Cabinet Installer HVAC Contractor

Carpentry Contractor Insulation Contractor

Carpet And Tile Contractor Interior Designer

Commercial Tenant Improvement Contractor Land Development Company

Concrete Contractor Landscape Contractor

Construction Company Masonry Contractor

Construction Manager Mold Remediation Company

Contracting Company Moss Removal Company

Contractor Painting Contractor

Custom Deck Builder Plumbing Contractor

Custom Home Builder Pressure Washing Company

Demolition Contractor Remodel Construction Company

Drywall Contractor Renovation Contractor

Electrical Contractor Restoration Contractor

Emerging Contractor Roofing Contractor

Excavation Contractor Spec Home Builder

Finish Millwork Contractor Specialty Contractor

Flipper House Contractor Subcontractor

Flooring Contractor Trade Contractor

Framing Contractor Underground Contractor

General Contractor Utility Contractor

Glass Installation Contractor Construction Employees

Gutter Installation Company Construction Support Specialist

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up Templates

Solopreneur

QuickBooks Chart Of Accounts

Free Stuff

QuickBooks Item Lists Templates

Consulting

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

If you are a blogger, who writes about construction we would like to hear from you.

https://www.fasteasyaccounting.com/guestblogger

Contractors_Success_MAP, Contractors_Success_Marketing_Accounting_Production, Contractor_Bookkeeping_Services, QuickBooks_For_Contractors, QuickBooks_For_Contractors,Contractors_Success_Map__Unique_High-Profit_Contractors_Count_All_Their_Income