Sep 7, 2018

This Podcast Is Episode Number 0285, And It Will Be About Contractor Bookkeeping Issues With Accounts Payable

It is easy to put transactions in Accounts Payable (A/P) Aging Summary, and them forget about them. When writing a check from the checking QuickBooks does not automatically go look to see if you put something in Accounts Payable. Sometimes Accounts Payable will have transactions in Accounts Payable that do not belong there.

For Example: Credit card balances or monthly payments. Credit cards like checking and savings accounts need to have all their transactions entered in and reconciled. Short-cutting and putting in a bill will distort the financial statements and will not have a clear understanding of details.

Taxes due to the Internal Revenue Service, State, and Local Payroll taxes or Sales tax-related obligations. Employee or owners child support payments do not belong in Accounts Payable.

Payments to and from the company and between owners is Owners Draw, Loan to Members or Loan To Shareholder and related transactions do not belong in Accounts Payable because you are not an outside vendor.

Do not create a bill for the company to pay. Anytime it is a company expense; the company should pay direct. There is nothing messier than constant reimbursements to the owner by the company. A bill with no detail just looks like a bogus payment to the owner trying to take money out the company that is being masked as an expense.

The old saying “Devil In The Details” Transactions in QuickBooks

need to be explainable without any need to have a story problem to

go with it. The Memo line in QuickBooks is short for a reason –

less is better and more transactions are better than fewer

transactions. Annual tax returns are many pages giving the detail

(which may be stated over and over again on numerous pages). As

with Accounts Receivable, the same type of detail applies to

Accounts Payable (A/P) Aging Summary.

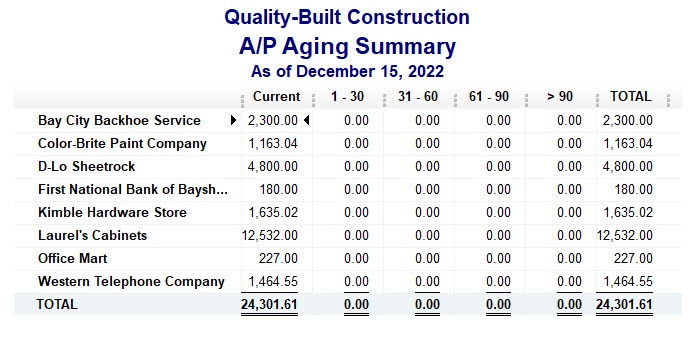

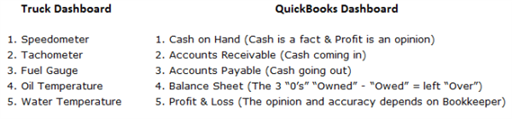

Accounts Payable (A/P) Aging Summary

Is Like The Fuel Gauge On Your

Vehicle

Are the transactions Current, 1-30, 31-60, 61-90, >90 and Total?

Add in the dimension of payment can be done from multiple banks, credit card accounts and in the case of suppliers, there may be credited to be applied. Any time there are unpaid balances the first place to look is, did the amount get paid directly from the checking account? Was the amount slightly different (including a late charge or additional vendor bill not entered into QuickBooks)?

Again if transactions are in as Accounts Payable, that should not be it gives the appearance of overinflated expenses. To be in QuickBooks under Accounts Payable, the transaction is being entered in as a bill. Any payments paid directly by the checkbook does not automatically know that a bill has been created. Same with any payment made with a credit card; there is no link between the credit card payment and the bill unless QuickBooks is told the bill was paid by credit card.

Negative numbers in Accounts Payable (A/P) Summary means that vendor was paid as a bill but without any bill being entered. Accounts Payable aging report reflects how long it is taking you to pay your bills.

Unless you have won the lottery (which we all want to do), then you need to collect before paying your bills. The most favorite way for Contractors to pay their bills is to Collect a job deposit, buy a new vehicle, tools or equipment and then pay any outstanding bills. When paying Old Bills with New Money (not money collected from the job that the billed were associated with) is “Robbing Peter To Pay Paul” (author unknown)

I get it. It is a more natural number to know. How much your customer owes you (especially if the job is Time and Material or Cost Plus) is hard. Not all of the bills may not have arrived from your Vendors or Sub Contractors. Then there is the issue of how you billed. Was it clear and easy for the customer to pay you?

What is guaranteed is the Bills will come and continue to occur. You may forget or forgive to the bill and receive payment from your Customer, but it is unrealistic to expect or hope that your Vendors, Suppliers or Subcontractors will do the same.

Bills, bills, and more bills are setups on auto-pay so they will get their money.

Question is how will you pay the bills? When will you pay the bills? Are you paying with Income from Customers? Credit Cards racking up your debt? The line of Credit which again is racking up debt? Personal savings or investments? (borrowing from tomorrow to pay for yesterday) Borrowing on your House?

Borrowing from a Pay Day Type of Lender (some take repayment daily automatically from your banking account) Borrowing from the Government by not filing and paying by the due dates.

Keeping up and paying bills is a challenge in the best of times. With proper bookkeeping you can know Whom You Owe, When Your Payment Is Due, If you plan you can pay off the balance in full. Moreover, my favorite is not double pay if it can be avoided.

It is a big deal to know the rules. Sometimes asking for a payment plan is the only option. If it is necessary, ask nicely, ask politely, ask as long of time pay as possible, for as small of a monthly payment as they will give you. It is better to double up on a low payment (to pay off sooner) then have a large payment that is impossible to pay.

Conclusion:

Helping Contractors around the world is one of the reasons we added the FastEasyAccountingStore.com

Follow our blogs, listen to Contractor Success M.A.P. Podcast. We Appreciate Our Visitors, Listeners, and Subscribers. – Thank You!!

Please feel free to download all the Free Forms and

Resources that you find useful for your business.

We are here to Help “A Little or A Lot” depending on your

needs.

In Conclusion:

Helping Contractors around the world

is one of the reasons we added the FastEasyAccountingStore.com

Follow our blogs, listen to Contractor Success M.A.P. Podcast. We Appreciate Our

Visitors, Listeners, and Subscribers. – Thank You!!

The Information Shown Below Is From Fast Easy Accounting

OUTSOURCED

ACCOUNTING FOR

THE BUSY CONTRACTOR

IN A MOBILE ENVIRONMENT

Download The Contractors APP Now!

Access code: FEAHEROS

The QR Code Below Will Go

Apple Or Android Store

Whichever One

You Need

Simply scan the QR code below or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7.

Access code: FEAHEROS

Or click to download the Contractors APP now from the App or Android store

Click here to download the App on iOS:

Click here to download the App on Android:

We are here to Help “A Little or A Lot” depending on your needs.

About The

Author:

![]()

https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

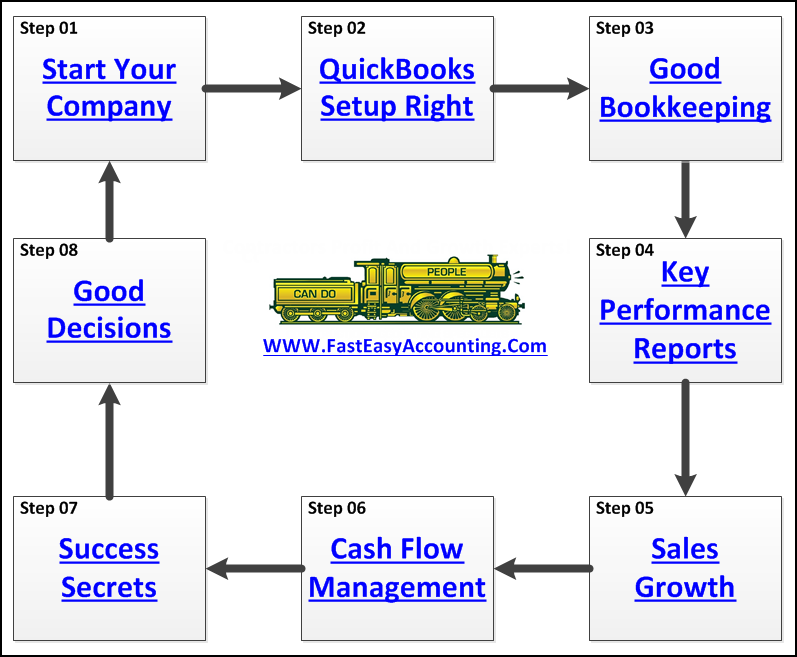

I trust this podcast helps you understand that outsourcing your contractor's bookkeeping services to us is about more than just “doing the bookkeeping”; it is about taking a holistic approach to your entire construction company and helping support you as a contractor and as a person.

We Remove Contractor's Unique Paperwork Frustrations

We understand the good, bad and the ugly about owning and operating construction companies because we have had several of them and we sincerely care about you and your construction company!

That is all I have for now, and if you have listened to this far please do me the honor of commenting and rating the Podcast www.FastEasyAccounting.com/podcast Tell me what you liked, did not like, tell it as you see it because your feedback is crucial and I thank you in advance.

You Deserve To Be Wealthy Because You Bring Value To Other People's Lives!

I trust this will be of value to you and your feedback is always welcome at www.FastEasyAccounting.com/podcast

This Is One more example of how Fast Easy Accounting is helping construction company owners across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to construction contractors like you so stop missing out and call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

Contractor Bookkeeping Done For You!

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Link Below:

This guide will help you learn what to look for in outsourced construction accounting.

Need Help Now?

Call Sharie 206-361-3950

Thank you very much, and I hope you understand we do care about

you and all contractors regardless of whether or not you ever hire

our services.

Bye for now until our next episode here on the Contractors Success

MAP Podcast.

Our Workflow Removes Your Paperwork Frustrations

For Contractors Who Prefer

To Do Your Bookkeeping

Fast Easy Accounting

Do-It-Yourself

Construction Accounting Store Is

Open

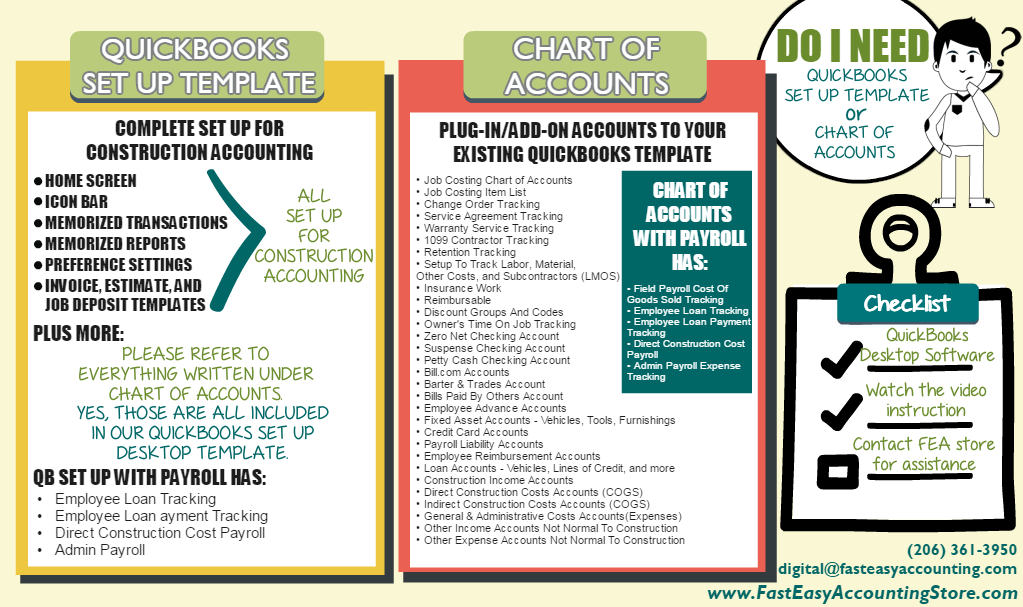

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Short List Of Construction Contractors We Serve

Asphalt ContractorAsphalt Contractor Brand New ContractorBrand New ContractorBrick And Stone ContractorBrick And Stone ContractorCabinet Installation ContractorCabinet Installation ContractorCarpentry ContractorCarpentry ContractorCarpet And Tile ContractorCarpet And Tile ContractorCommercial Tenant Improvement ContractorCommercial Tenant Improvement ContractorConcrete ContractorConcrete ContractorConstruction EmployeesConstruction EmployeesConstruction ManagerConstruction ManagerConstruction Support SpecialistConstruction Support SpecialistCustom Deck ContractorCustom Deck ContractorCustom Home BuilderCustom Home BuilderDemolition ContractorDemolition ContractorDrywall ContractorDrywall ContractorElectrical ContractorElectrical ContractorEmerging ContractorEmerging ContractorExcavation ContractorExcavation ContractorFinish Millwork ContractorFinish Millwork ContractorFlipper House ContractorFlipper House ContractorFlooring ContractorFlooring ContractorFoundation ContractorFoundation ContractorFraming ContractorFraming ContractorGeneral ContractorGeneral ContractorGlass Installation ContractorGlass Installation ContractorGutter ContractorGutter ContractorHandyman ContractorHandyman ContractorHot Tub ContractorHot Tub ContractorHVAC ContractorHVAC ContractorInsulation ContractorInsulation ContractorInterior Designer ContractorInterior Designer ContractorLand Development ContractorLand Development ContractorLandscape ContractorLandscape ContractorLawn And Yard Maintenance ContractorLawn And Yard Maintenance ContractorMasonry ContractorMasonry ContractorMold Remediation ContractorMold Remediation ContractorMoss Removal ContractorMoss Removal ContractorPainting ContractorPainting ContractorPlaster ContractorPlaster ContractorPlaster And Stucco ContractorPlaster And Stucco ContractorPlumbing ContractorPlumbing ContractorPressure Washing ContractorPressure Washing ContractorRemodel ContractorRemodel ContractorRenovation ContractorRenovation ContractorRestoration ContractorRestoration ContractorRoofing ContractorRoofing ContractorSiding ContractorSiding ContractorSpec Home BuilderSpec Home BuilderSpecialty ContractorSpecialty ContractorStone Mason ContractorStone Mason ContractorStucco ContractorStucco ContractorSubcontractorSubcontractorSwimming Pool ContractorSwimming Pool ContractorSwimming Pool And Hot Tub ContractorSwimming Pool And Hot Tub ContractorTile And Carpet ContractorTile And Carpet ContractorTrade ContractorTrade ContractorTree ContractorTree ContractorUnderground ContractorUnderground ContractorUtility ContractorUtility ContractorWaterproofing ContractorWaterproofing ContractorWindow ContractorWindow Contractor

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up TemplatesSolopreneurQuickBooks Chart Of AccountsFree StuffQuickBooks Item Lists TemplatesConsulting

We Serve Over 100 Types Of Contractors So If Your Type Of

Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up

Templates Solopreneur

QuickBooks Chart Of Accounts

Free

Stuff

QuickBooks Item Lists Templates

Consulting

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

If you are a blogger, who writes about construction we would like to hear from you.

https://www.fasteasyaccounting.com/guestblogger

Contractors_Success_MAP, Contractors_Success_Marketing_Accounting_Production, Contractor_Bookkeeping_Services, QuickBooks_For_Contractors, QuickBooks_For_Contractors,Contractors_Success_Map_Unique_Contractor_Bookkeeping_Problems_With_Payables