In almost all cases, in addition to visiting the local pawn

shop if an employee does not get paid "On Time," they may contact

your local state agencies and even Federal agencies for assistance.

Please understand payday is "Results Driven," your results, not

theirs and "No Excuses Allowed."

1. Pay Employees

2. Fill out Government Forms

3. Job Costing for a better bottom line

As the employer, you need to have the

timecard as the foundation for making

sure employees get paid. Employees need to fill-it-out their

timecard and total it, including anyone on salary. You can create

your timecard, or you can download our

FREE timecard form and modify it to fit

your needs. Timecard needs to be something more than a few numbers

scribbled on the back of a paper bag or the nearest Home Depot

receipt (those are already full of footprints and coffee

stains).

After all, timecards (timesheets) are entered into QuickBooks,

save and file them. Do this even if you are using a 3rd party

payroll processor. You may need to reference the information

later.

Timecards should have the following - the more the

detail, the better:

- Hours Worked with Start / Stop and lunch breaks

Quarterly tax returns for Washington State

Employment Security and Washington State Labor & Industries

cross-reference each other to review the same employee wage data in

different ways.

Quarterly tax returns for Washington State Employment Security

Quarterly Reports want employee wage detail, including:

Washington State Labor And Industries Wants Summary Data

Including:

- Total hours per classification

- Total wages per classification

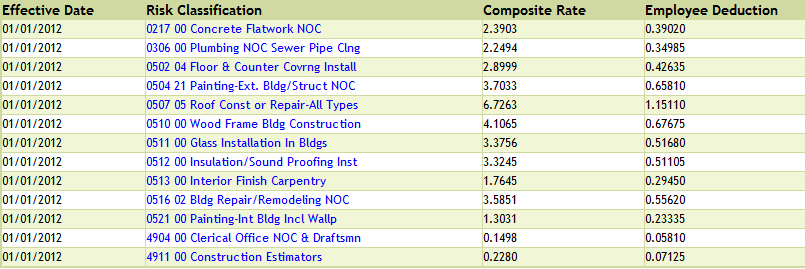

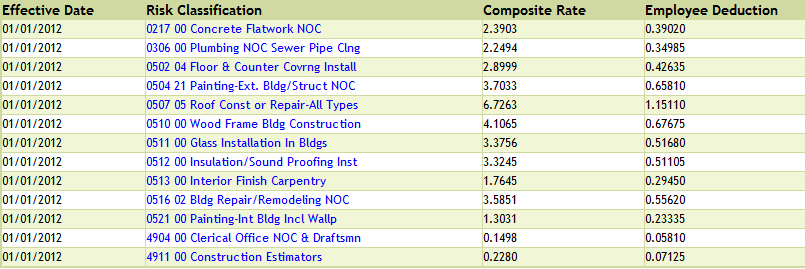

Washington State Labor And Industries set the rate for each

contractor based on their experience rating.

Example of Washington State L&I Contractor

Rates

It is always optional to take the employee deduction from

employees paycheck based on risk classification worked. Taking more

than allowed is not acceptable.

We recommend all construction company owners deduct the

maximum allowed from each employee and bring it up early and often

in your safety meetings because it helps them focus more attention

on safety which helps lower overhead costs and benefits everyone.

It is essential to understand the Psychology of Construction Field

Employees.

Click here for more.

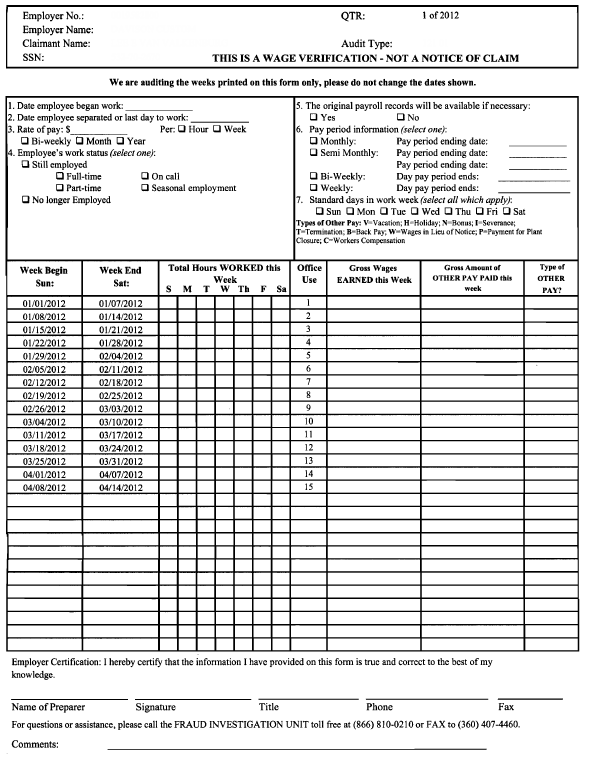

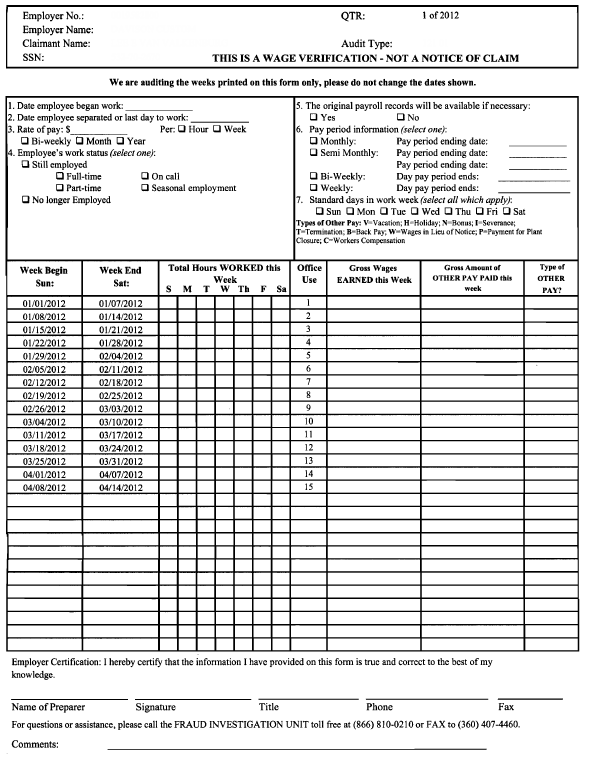

Whenever any employee is requesting unemployment benefits,

their request is sent to the employer to verify they are or have

been an employee. The Washington State Employment Security computer

may auto-fill the form and sends a letter to the first company on

the list. It is imperative that someone in your office

double-checks the accuracy of the request and notify the Washington

State Employment Security if it is not your employee. Companies

have similar names, and each state wants to apply the risk to the

proper company. They also want to verify if any employee is saying

they have worked for a company which they were a 1099 contract

employee or trying to submit a fraudulent claim.

Part-Time Employees

What about an employee who is working part-time and sometimes

receiving unemployment benefits?

Washington State Employment Security will send a form for the

employee to fill out, breaking down the hours and gross pay

week-by-week for a period that is in question.

Example of Washington State Employment Security Wage

Verification

This can be for all the hours worked from a 12 to 52 week

period, including time worked during the previous year. Your source

document is the timecards and pay-stubs, and you may need it if you

have to prove their hours and the more detail in their handwriting,

the better!

Washington State Employment Security wants to

know:

- Does the social security number match?

- Is there any other type of benefits?

- What is the last day of the pay period?

- Are original timecards (sheets) available?

- What are the daily hours with a weekly total?

- What is the weekly total earned?

- What day were the wages paid?

- The dollar amount of wages paid?

Conclusion:

All forms are easy to fill out if you have all the data in a

readily usable format that accessible. What you do as a contractor

is "Easy To Do" if it is something you do all of the time.

As QuickBooks experts in Contractors accounting and

contractors bookkeeping, paperwork is our particular skill set. We

know what to do! Let us help you so you can do what you do

best!

We help a little or a lot depending on your needs. I look

forward to being able to assist you with any option that best fits

your company.

Please feel free to download all the Free

Forms and Resources that you find useful for your business.

About The Author:

Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

206-361-3950 or sharie@fasteasyaccounting.com

Download the Contractors APP

today from the App

Store or Android

Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in

the App Store and enter the Access

code: FEAHEROS to utilize the powerful App

features and capabilities, and benefit from having our Construction

Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction

Contractor you will find a plenty of benefits in the app

so we invite you to download it too! It's Free so why not?

When

You Become A Client - Then we can tap into our resources of

knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to

diagnose and understand your construction business and develop

plans and help you implement a path to success for you and you

alone because every contractor has unique Strengths, Weaknesses,

Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to

a Strategic Roadmap which cannot

help but make a lot of money.

We Remove Contractor's Unique Paperwork

Frustrations

![]() Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

206-361-3950 or sharie@fasteasyaccounting.com