Aug 11, 2017

This Podcast Is Episode Number 0229, And It Will Be About Secret To Highly Profitable Contractor Is The Construction Accountant

Contractors Need Help Understanding Role of Accountants

Contractors should have two primary accountants. One is the Tax Accountant the other is your Construction Accountant. Tax Accountant who does the Annual tax return for your business and your personal tax return.

Why You Need A Tax Accountant?

It is the role of the Tax Accountant to Roll Your Numbers up into a tax return. The first (2) pages of your annual tax return is a summary of all the pages, worksheets that follow. Everything must roll up to those two pages. That means that you could have multiple numbers from multiple pages that might go on a single line. The Tax Accountant manages those numbers.

Remember when you were single and could use the EZ form?

Then you got married and maybe were still able to file using the EZ

form.

Add buying a house, and having children and things got a little

more complicated.

Now you are a business owner. You owe more taxes.

The bottom line is that every missed personal deduction; every

missed business expense costs you money.

The Tax Accountant takes all of the summary numbers from your

business return (the 1120s – S-Corp) and put them in the

appropriate places on your personal return. If you are a Sole

Proprietor or an LLC that is taxed as a Sole Proprietor than a

Schedule C is part of your personal tax return.

When you are a Sole Proprietor or an LLC that is taxed as a Sole

Proprietor, you will have the additional taxes in the form of Self

Employment Taxes. Self-Employment Taxes are payroll taxes on your

net profit.

Self-Employment Tax is a separate tax from your Federal Income

Taxes. You could owe “No Federal Tax” after all of your personal

deductions are applied but still owe Self Employment Tax. It is a

Different Line.

The Tax Accountant has one goal – Roll all the numbers up (no

matter how many pages it takes) to find the answer to How Much Do

You The Contractor Owe In Taxes?

Taxes from one year impacts the Estimated Taxes Due The Following

Year. The IRS has an expectation you will do equal to or better

than the previous year and need to pay Estimated Taxes

accordingly.

Sharie’s Nickname for

Self-Employment Tax is “sneaker tax” Almost every

Contractor knows how much their Federal Income Tax Rate is and can

project about what the tax owed is. The Self Employment Tax is

often a forgotten tax and comes as HUGE Surprise (unlike Christmas

morning – it is not a fun surprise when you owe money instead of

getting a refund to something fun).

Based on the tidiness of your paperwork how easy it is for the Tax

Accountant to do their job. The last thing any Tax Accountant knows

about let alone wants to show their lack of understanding about

what you do is to talk about is your job costing, job profitability

reports or anything else related to your numbers.

Why You Need A Construction Accountant?

Now let’s chat about what should be the Other Accountant in your

life. We are Construction Accountants, and our role with your

numbers is exactly the opposite of the Tax Accountant.

QuickBooks is designed to serve a dual function.

Roll up the numbers for the Tax Accountant. Be able to drill

down on any number or group of numbers to give the Tax Accountant

the answers needed to be able to take every deduction allowed.

The more important part of a Construction Accountant is making the

numbers so you The Contractor can see quickly see the numbers in a

way that makes sense to you. The answers are in

QuickBooks.

The good (money in), the bad (money out), the ugly (maybe more

unpaid bills are left over than cash in the bank)

Many contractors run their accounting software like an “overgrown

checkbook, ” and this method does get most of everything the tax

accountant needs to file the annual taxes.

What The Checkbook And Shoebox Method Doesn’t Tell You:

- Did you remember to bill all your clients?

- Did you remember to bill for the change order?

- Are you sure someone isn’t using your wholesale account?

- Are you sure someone isn’t using your equipment after hours?

- Are you sure your employees are on the job when they say they are?

- Are you sure someone isn’t driving your company vehicle two states away on the weekend?

- If you are unable to track who you billed, then how do you know if you have collected from them?

There are many online invoice programs and some really

inexpensive accounting programs.

Contractors call me every day and say; “I chose this program to get

me by” and now I am ready to learn more about my business so I can

make better decisions to grow.

States that allowed 1099 Contractors are now enforcing the rules

about employees.

Many Worker’s Comp Programs want details about Subcontractors

including Certificate of Insurance

Sales Tax is happening in more states. In Washington, not

Collecting and Remitting Sales Tax is by exception. Add in Sales

Tax being destination based and needs to be tracked by the city,

town, county across the entire state. And yes, the individual

cities may vote to increase their sales tax rates during the

year.

Taxes are one of the reasons to track more; be aware of more is a

way of life to Construction Contractors. If a Contractor focused on

doing everything about their paperwork perfectly 100% of the time

the paperwork would take all of their time. – And the jobs would

Never Get Done!

Professional Construction Accounting Helps

Contractors Make Every Neighborhood A Better Place To Live. As

Construction Accountants, We Focus On What You Need To Run Your

Business Better.

Looking forward to getting started.

About The Author:

![]()

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

I trust this podcast helps you understand that outsourcing your contractor's bookkeeping services to us is about more than just “doing the bookkeeping”; it is about taking a holistic approach to your entire construction company and helping support you as a contractor and as a person.

We Remove Contractor's Unique Paperwork Frustrations

We understand the good, bad and the ugly about owning and operating construction companies because we have had several of them and we sincerely care about you and your construction company!

That is all I have for now, and if you have listened to this far please do me the honor of commenting and rating podcast www.FastEasyAccounting.com/podcast Tell me what you liked, did not like, tell it as you see it because your feedback is crucial and I thank you in advance.

You Deserve To Be Wealthy Because You Bring Value To Other People's Lives!

I trust this will be of value to you and your feedback is always welcome at www.FastEasyAccounting.com/podcast

This Is One more example of how Fast Easy Accounting is helping construction company owners across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to construction contractors like you so stop missing out and call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

Contractor Bookkeeping Done For You!

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Link Below:

This guide will help you learn what to look for in outsourced construction accounting.

Need Help Now?

Call Sharie 206-361-3950

Thank you very much, and I hope you understand we do care about

you and all contractors regardless of whether or not you ever hire

our services.

Bye for now until our next episode here on the Contractors Success

MAP Podcast.

Enjoy your day.

Sharie

About The

Author:

![]() https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Our Workflow Removes Your Paperwork Frustrations

For Contractors Who Prefer

To Do Your Bookkeeping

Fast Easy Accounting

Do-It-Yourself

Construction Accounting Store Is

Open

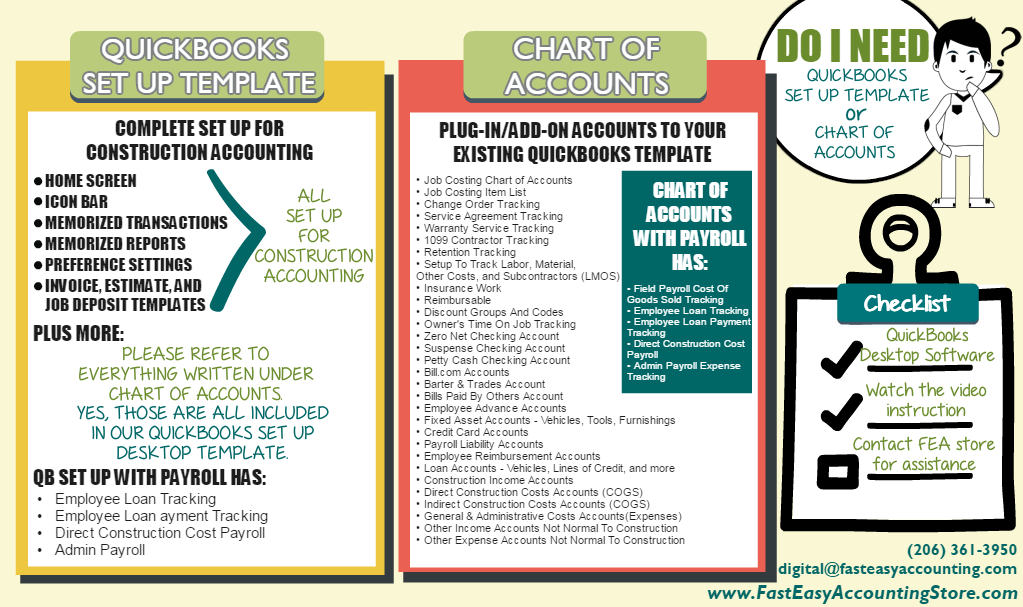

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Short List Of Construction Contractors We Serve

Asphalt ContractorAsphalt Contractor Brand New ContractorBrand New ContractorBrick And Stone ContractorBrick And Stone ContractorCabinet Installation ContractorCabinet Installation ContractorCarpentry ContractorCarpentry ContractorCarpet And Tile ContractorCarpet And Tile ContractorCommercial Tenant Improvement ContractorCommercial Tenant Improvement ContractorConcrete ContractorConcrete ContractorConstruction EmployeesConstruction EmployeesConstruction ManagerConstruction ManagerConstruction Support SpecialistConstruction Support SpecialistCustom Deck ContractorCustom Deck ContractorCustom Home BuilderCustom Home BuilderDemolition ContractorDemolition ContractorDrywall ContractorDrywall ContractorElectrical ContractorElectrical ContractorEmerging ContractorEmerging ContractorExcavation ContractorExcavation ContractorFinish Millwork ContractorFinish Millwork ContractorFlipper House ContractorFlipper House ContractorFlooring ContractorFlooring ContractorFoundation ContractorFoundation ContractorFraming ContractorFraming ContractorGeneral ContractorGeneral ContractorGlass Installation ContractorGlass Installation ContractorGutter ContractorGutter ContractorHandyman ContractorHandyman ContractorHot Tub ContractorHot Tub ContractorHVAC ContractorHVAC ContractorInsulation ContractorInsulation ContractorInterior Designer ContractorInterior Designer ContractorLand Development ContractorLand Development ContractorLandscape ContractorLandscape ContractorLawn And Yard Maintenance ContractorLawn And Yard Maintenance ContractorMasonry ContractorMasonry ContractorMold Remediation ContractorMold Remediation ContractorMoss Removal ContractorMoss Removal ContractorPainting ContractorPainting ContractorPlaster ContractorPlaster ContractorPlaster And Stucco ContractorPlaster And Stucco ContractorPlumbing ContractorPlumbing ContractorPressure Washing ContractorPressure Washing ContractorRemodel ContractorRemodel ContractorRenovation ContractorRenovation ContractorRestoration ContractorRestoration ContractorRoofing ContractorRoofing ContractorSiding ContractorSiding ContractorSpec Home BuilderSpec Home BuilderSpecialty ContractorSpecialty ContractorStone Mason ContractorStone Mason ContractorStucco ContractorStucco ContractorSubcontractorSubcontractorSwimming Pool ContractorSwimming Pool ContractorSwimming Pool And Hot Tub ContractorSwimming Pool And Hot Tub ContractorTile And Carpet ContractorTile And Carpet ContractorTrade ContractorTrade ContractorTree ContractorTree ContractorUnderground ContractorUnderground ContractorUtility ContractorUtility ContractorWaterproofing ContractorWaterproofing ContractorWindow ContractorWindow Contractor

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up TemplatesSolopreneurQuickBooks Chart Of AccountsFree StuffQuickBooks Item Lists TemplatesConsulting

We Serve Over 100 Types Of Contractors So If Your Type Of

Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up Templates

Solopreneur

QuickBooks Chart Of Accounts

Free Stuff

QuickBooks Item Lists Templates

Consulting

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

If you are a blogger, who writes about construction we would like to hear from you.

https://www.fasteasyaccounting.com/guestblogger

Contractors_Success_MAP, Contractors_Success_Marketing_Accounting_Production, Contractor_Bookkeeping_Services, QuickBooks_For_Contractors, QuickBooks_For_Contractors,Contractors_Success_Map_Secret_To_Highly_Profitable_Contractor_The_Construction_Accountan