Dec 1, 2017

This Podcast Is Episode Number 0245, And It Will

Be About Unique Secrets To Starting A Highly Profitable Handyman

Company

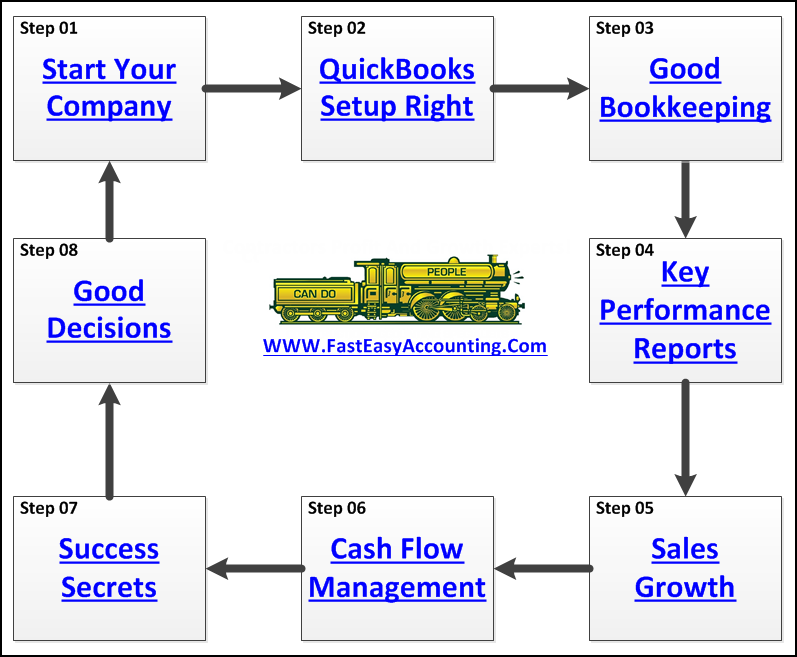

Basics of Starting Your Handyman Company

- First Place to decide what type of contracting business do you want to start.

- For many contractors, the Place To Begin is to choose to be a handyman.

Why do I suggest a Handyman?

- No one expects a Handyman to have the skills of a High-End Finish Carpenter.

- It will give you an opportunity to try many things.

- Learn how to make simple repairs.

- Determine what you like to do and learn the skills associated with that trade.

- Many states have a basic license for the Handyman.

The best place to learn about starting up and operating a highly profitable Handyman Company is Dan Perry Handyman Startup. Here is a link to his online course that is only open twice a year. Get on the list.

The next steps are all about Company Structure. We recommend being an S-Corp because it has several benefits over any other structure like LLC, C-Corp, and Partnership.

Many Tax Accountants And Lawyers Suggest Setting Up Your Company As An LLC

They like it because it is simple and cheap to set up in the

beginning and they do not care how much you will be overpaying on

your Income Tax! In most cases, they will set up your Handyman

Company to be taxed as a Sole Proprietor, which means you will pay

payroll taxes on all the net profit. In the first year in business,

this might be almost nothing.

The problem is that a Handyman Company Owners and Construction

Contractors never go into business with the idea of NOT MAKING A

PROFIT. The difference between a Not Profitable Company and a

Profitable Construction Company can be a few jobs that went well

and paid before the end of the year.

You cannot go back to the IRS

and say – I changed my mind, and now I want to be

treated as an S-Corp for this year because I made a profit. It

doesn’t work that way. For an LLC – forms must be filled out early

in the new year for that year and can be treated as an S-Corp every

year going forward.

When a Handyman Company Owner or a Construction Contractor chooses

to be an S-Corp in the beginning, then no one gets confused on what

you expect. An S-Corp is always treated as an S-Corp. Just a quick

heads up; Corporate Officers must take a reasonable salary (W-2

income) and the balance either as dividends or invests it in

retirement accounts. It defeats the purpose to be in business if a

Corporate Officer takes payroll for every dollar taken out of the

company.

If you want to be paid like a regular employee, then save yourself

a headache and be an employee for someone else. Being in business

is full of challenges, some fun, and others not so much fun.

Decisions are made every day (many days it feels like every minute

of every day). As the Owner, there is no one to tell you what you

supposed to do or what you have to do. Of course, there are nasty

letters, phone calls, or fines and penalties when do you not pay

what you are supposed to pay by the due date.

When choosing a name for your Handyman or Construction Company, I

recommend that the Corporate Identify is more general and not an

exact match to the Trade Name you may be using. Why – because

as an S-Corporation you can evolve and change what you do and keep

the same Corporate Structure.

We started out as Construction Contractors, at one time we were

General Contractors and at some point changed to being

predominately a Specialty Trade Contractor. Individual changes

within that space, we worked New Construction, Remodel, Service,

and Repair - all of which were slightly different.

Employees that were fantastic in New Construction did not do well

in Residential Remodel projects, or Commercial Tenant Improvement

(TI) Projects and Vice versa. An entirely different group of

employees loved service and repair but were clueless when it came

to New Construction for Residential Remodel or TI Projects.

We have been Construction Accountants for many years now but

remember each of the phases of our own career. From permits,

sitting for inspections, wearing a hard hat, buying safety glasses

by the case, and a zillion and one other OSHA and safety items. We

have not forgotten what it is like on your side of the world, in

the trenches, doing the work that needs to be done in the mud, the

blood, the sweat and the tears.

The next step in your business search is where do you want to do

business? My recommendation is to have an office, warehouse,

mailing address away from home. Your home is your castle, and you

need to put Family First. The last thing you need is a drunken

employee or customer showing up on Saturday night to talk about

what they don't like about you or your company.

As a contractor, you can handle anything and everything. But you

need to have the peace of mind that no one is calling or dropping

by your house to leave or pick up a check, discuss the job (good or

bad) after a few beers. In my opinion, this also includes

employees.

It sounds cost effective to have your shop in the garage or

basement. Not so nice if those same employees do not respect your

personal space and go wandering in your bedrooms, family rooms,

kitchen and anywhere else they please. Get a business address.

Nothing is so important that you can’t handle during the day or to

meet someone away from home and family.

I strongly recommend you do this before you set up your business.

This will limit the number of places your home address is listed.

Government Agencies can find you for behind the scenes you and your

company are tied together (and somewhere that will include your

home address) What you are limiting is the number of places your

home address is in public view for everyone to see and drop by

unannounced.

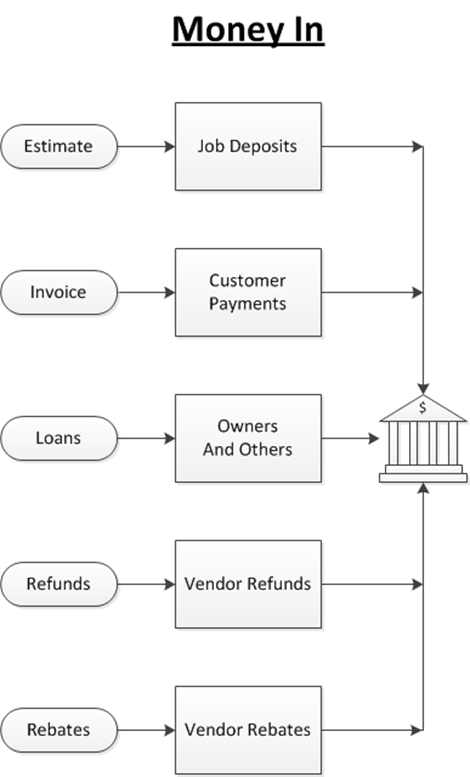

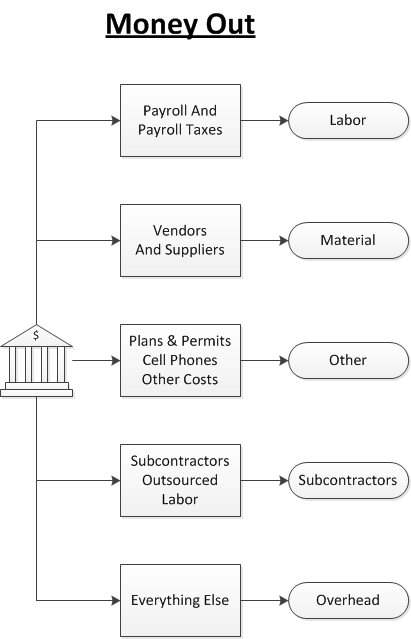

Tracking The Money In and Out

Set up more than one bank account. Limit the amount of money in the account with a debit card. If the Debit Card is lost – all the money in the account is a lot no matter who you are. Setup business checking accounts (even if you are a sole prop) and pay business expenses out of business checking accounts.

Lend your Handyman Company money as needed. With a good Construction Accounting System that money will be

tracked. You can pay yourself back. Without a good Construction

Accounting System then it is too easy for the money to appear as

income and therefore taxable.

Many Construction Contractors pull money out of the company only to

determine they needed to put the funds back into the Construction

Company to pay bills or purchase material to do the next

project. Designate personal credit cards for business and try

to never use them for personal. This again helps isolate business

from personal expenses.

- In the end – Did you make a profit?

- Did you remember to show all your expenses in your Construction Accounting?

- Many expenses that were personal now are a business expense (vehicle, cell phone, etc.)

- Did you collect all the money due to you?

- Are you using an Estimating Program?

- Did you get signed Change Orders?

- Are you using Online Invoicing?

- Did you get a signed Contract?

- Do you accept Credit Cards?

It is all about the three O’s. Who Owes you money? Who do you

Owe money? What do you Own?

Everyone started out as a New Construction Contractor – Your

challenges are not new.

Do you have any money left over to do what you want to do?

Wishing you the best as the Holiday Season approaches.

Sharie

In Conclusion:

Helping Contractors around the world is one of the reasons we added the FastEasyAccountingStore.com

Follow our blogs, listen to Contractor Success M.A.P. Podcast. We Appreciate Our Visitors, Listeners, and Subscribers. – Thank You!!

Please feel free to download all the Free Forms and

Resources that you find useful for your business.

We are here to Help “A Little or A Lot” depending on your

needs.

About The

Author:

![]() https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

I trust this podcast helps you understand that outsourcing your contractor's bookkeeping services to us is about more than just “doing the bookkeeping”; it is about taking a holistic approach to your entire construction company and helping support you as a contractor and as a person.

We Remove Contractor's Unique Paperwork Frustrations

We understand the good, bad and the ugly about owning and operating construction companies because we have had several of them and we sincerely care about you and your construction company!

That is all I have for now, and if you have listened to this far please do me the honor of commenting and rating the Podcast www.FastEasyAccounting.com/podcast Tell me what you liked, did not like, tell it as you see it because your feedback is crucial and I thank you in advance.

You Deserve To Be Wealthy Because You Bring Value To Other People's Lives!

I trust this will be of value to you and your feedback is always welcome at www.FastEasyAccounting.com/podcast

This Is One more example of how Fast Easy Accounting is helping construction company owners across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to construction contractors like you so stop missing out and call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

Contractor Bookkeeping Done For You!

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Link Below:

This guide will help you learn what to look for in outsourced construction accounting.

Need Help Now?

Call Sharie 206-361-3950

Thank you very much, and I hope you understand we do care about

you and all contractors regardless of whether or not you ever hire

our services.

Bye for now until our next episode here on the Contractors Success

MAP Podcast.

Enjoy your day.

Sharie

About The

Author:

![]() https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Our Workflow Removes Your Paperwork Frustrations

For Contractors Who Prefer

To Do Your Bookkeeping

Fast Easy Accounting

Do-It-Yourself

Construction Accounting Store Is

Open

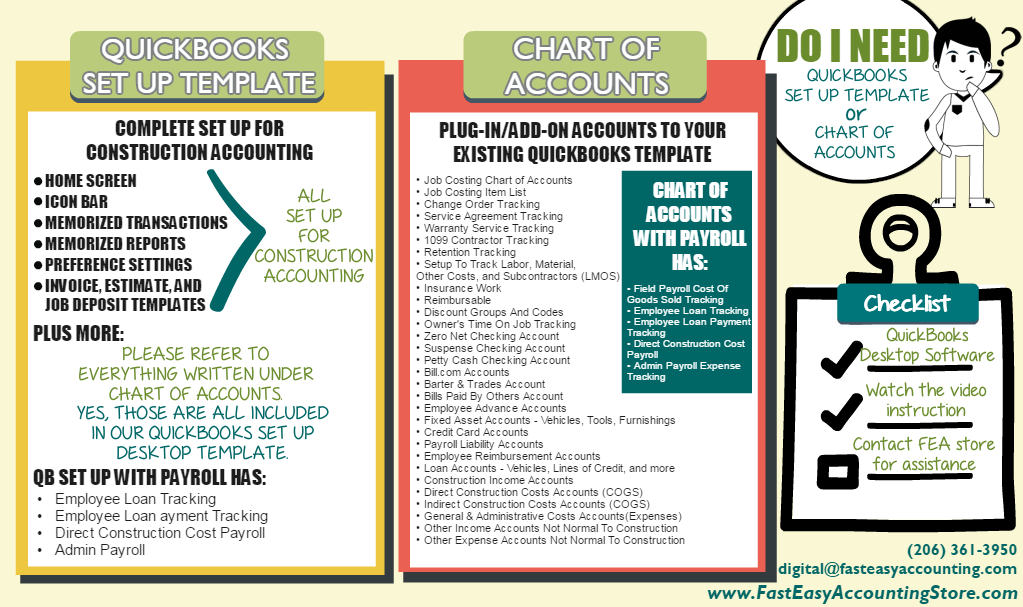

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Short List Of Construction Contractors We Serve

Asphalt ContractorAsphalt Contractor Brand New ContractorBrand New ContractorBrick And Stone ContractorBrick And Stone ContractorCabinet Installation ContractorCabinet Installation ContractorCarpentry ContractorCarpentry ContractorCarpet And Tile ContractorCarpet And Tile ContractorCommercial Tenant Improvement ContractorCommercial Tenant Improvement ContractorConcrete ContractorConcrete ContractorConstruction EmployeesConstruction EmployeesConstruction ManagerConstruction ManagerConstruction Support SpecialistConstruction Support SpecialistCustom Deck ContractorCustom Deck ContractorCustom Home BuilderCustom Home BuilderDemolition ContractorDemolition ContractorDrywall ContractorDrywall ContractorElectrical ContractorElectrical ContractorEmerging ContractorEmerging ContractorExcavation ContractorExcavation ContractorFinish Millwork ContractorFinish Millwork ContractorFlipper House ContractorFlipper House ContractorFlooring ContractorFlooring ContractorFoundation ContractorFoundation ContractorFraming ContractorFraming ContractorGeneral ContractorGeneral ContractorGlass Installation ContractorGlass Installation ContractorGutter ContractorGutter ContractorHandyman ContractorHandyman ContractorHot Tub ContractorHot Tub ContractorHVAC ContractorHVAC ContractorInsulation ContractorInsulation ContractorInterior Designer ContractorInterior Designer ContractorLand Development ContractorLand Development ContractorLandscape ContractorLandscape ContractorLawn And Yard Maintenance ContractorLawn And Yard Maintenance ContractorMasonry ContractorMasonry ContractorMold Remediation ContractorMold Remediation ContractorMoss Removal ContractorMoss Removal ContractorPainting ContractorPainting ContractorPlaster ContractorPlaster ContractorPlaster And Stucco ContractorPlaster And Stucco ContractorPlumbing ContractorPlumbing ContractorPressure Washing ContractorPressure Washing ContractorRemodel ContractorRemodel ContractorRenovation ContractorRenovation ContractorRestoration ContractorRestoration ContractorRoofing ContractorRoofing ContractorSiding ContractorSiding ContractorSpec Home BuilderSpec Home BuilderSpecialty ContractorSpecialty ContractorStone Mason ContractorStone Mason ContractorStucco ContractorStucco ContractorSubcontractorSubcontractorSwimming Pool ContractorSwimming Pool ContractorSwimming Pool And Hot Tub ContractorSwimming Pool And Hot Tub ContractorTile And Carpet ContractorTile And Carpet ContractorTrade ContractorTrade ContractorTree ContractorTree ContractorUnderground ContractorUnderground ContractorUtility ContractorUtility ContractorWaterproofing ContractorWaterproofing ContractorWindow ContractorWindow Contractor

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up TemplatesSolopreneurQuickBooks Chart Of AccountsFree StuffQuickBooks Item Lists TemplatesConsulting

We Serve Over 100 Types Of Contractors So If Your Type Of

Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up

Templates Solopreneur

QuickBooks Chart Of Accounts

Free

Stuff

QuickBooks Item Lists Templates

Consulting

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

If you are a blogger, who writes about construction we would like to hear from you.

https://www.fasteasyaccounting.com/guestblogger

Contractors_Success_MAP, Contractors_Success_Marketing_Accounting_Production, Contractor_Bookkeeping_Services, QuickBooks_For_Contractors, QuickBooks_For_Contractors,Contractors_Success_Map_Unique_Secrets_To_Starting_A_Highly_Profitable_Handyman_Company