Oct 1, 2021

This Podcast Is Episode Number 439, And It's About Understanding Roles And Why It Makes Sense To Hire Us

Three Skill Sets = Three Types Of People

Bookkeeper

The primary role of a bookkeeper is to handle a company's day-to-day financial management. A bookkeeper will take care of the small but essential details essential for providing an accurate picture of where a business stands at any given moment.

In addition to a bookkeeper's main job – making sure every financial transaction is accurately recorded in the general ledger – they may also take over other critical tasks like invoicing, paying suppliers and vendors, and processing payroll.

Ideally, a construction company's books are updated at the end of each business day, so you always have an accurate account of your sales, expenses, and the bottom line. However, if your business is still in its early stages, without much financial activity or the funds to hire a bookkeeper, you should aim to reconcile your accounts at least once a week.

Accountant

An accountant's primary role is to help companies make sense of their numbers for strategic planning - analyzing, summarizing, interpreting, and reporting financial data to provide "big picture" business advice.

As a construction business owner, you'll want to work with an accountant from very early days to help with budgeting, forecasting, and decision making – as well as for strategic tax advice and identifying opportunities to reduce costs and maximize profitability.

Many business owners think they only need to talk to their accountant once a year at tax time. But to be able to gauge the health of your business - and make the most of your accountant's expertise - it's recommended you check in at least once a month.

Your monthly meeting is a chance to review key reports, like your profit and loss statement, discuss opportunities or areas of concern, and get timely advice to help meet the goals you've set out in your annual business plan.

Certified Public Accountant

The C.P.A.'s primary function is to prepare the annual tax return, perform audits, and prepare Certified Financial Statements for bank loans when a construction contractor requires them before issuing a construction bond. Keep in mind that most Certified Public Accountant accounting specialists can do all accounting for most standard businesses that only need regular accounting but not construction accounting. Construction company owners who think it's costly to hire a construction accountant and would instead only seek a C.P.A.'s help might be in for more business damage in the long run.

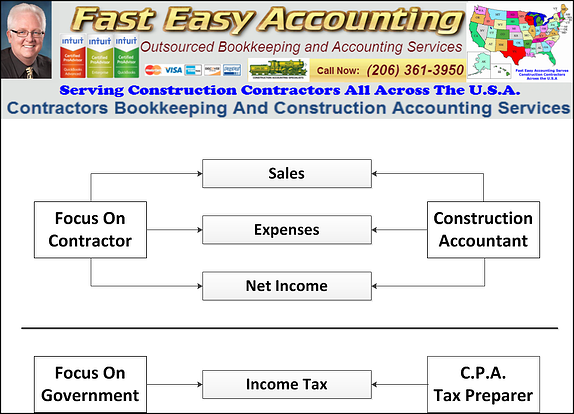

What C.P.A.'s Do And What Construction Accountants Do

Why it makes sense to hire us

We pride ourselves on employing the most competent construction bookkeeping professionals and ProAdvisors in the business. Our employees have passed our extensive test, a thorough background check, and a personality screening process. Most of our employees have over 10,000 hours of bookkeeping experience. This level of expertise is tough to find when seeking a part-time employee.

Unlike hiring employees, you don't pay for any 'down time' or office chatter, excessively long breaks, cell phone calls, surfing the web. You are charged only for the time our professional bookkeepers are doing your construction bookkeeping work. Our people have the knowledge, skill and we have systems in place to work fast, saving you time and money.

Online Data Protection is critical to providing you reliable and professional-grade outsourced contractor's bookkeeping services. At Fast Easy Accounting, Cloud Security is not an option- it is a fundamental requirement. We only use Intuit Approved Commercial Hosting Services. We have taken steps to select the best to ensure that your data is as secure as that found for online banking and financial institutions. Their Cloud Security rests on U.S.-based servers, backups, data centers, and technical support. Not one aspect of our Cloud security relies on outsourced services or offshore locations.

We do not offer long-term contracts even though contractors have asked for them. The reason they ask for them is to protect themselves against price hikes and unpleasant hourly billing surprises. They love it when they understand that we offer fixed flat-rate pricing and that the agreement is month-to-month. This means the burden is on us to perform at a high level, constantly innovate, modernize and improve our services because every bookkeeper, accountant, and support staff member's livelihood and future paychecks depend on being re-hired every month by our contractor clients.

Final thoughts

Construction Accountants should not be preparing annual tax returns - either be a tax accountant and serve the interest of the tax collection agencies or be a construction accountant and serve the interest of contractors. C.P.A.'s are like I.R.S. agents in that they owe their primary allegiance to the tax collecting agencies, and that is O.K. because the government needs our tax dollars to operate.

Construction accountants owe their primary allegiance to the contractor. Our role is to help the contractor optimize their construction company to generate the most cash flow and profit over the long term.

About The Author:

![]() Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

1-800-361-1770 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

1-800-361-1770 or sharie@fasteasyaccounting.com