Apr 7, 2017

This Podcast Is Episode Number 0211 And It Will Be About Contractors Messy Bookkeeping Issues Solved

Messy Bookkeeping Happens Just A Little At A Time

When Contractors are doing their own bookkeeping, it becomes a problem that grows and grows

There is not any limits to the number of transactions that can be entered into QuickBooks improperly.

Messy files build transaction by transaction or more simply put invoice by invoice, receipt by receipt all can be entered into QuickBooks improperly. There is no popup that says “This Is WRONG” – Do It Over.

Unlike loading the dishwasher or washing socks which have an end. You run out of dishes or can’t find clean socks. Filling up the dishwasher will magically produce clean dishes.

After loading, adding soap, and pushing start the rest happens

automatically. Quality of clean dishes depends on soap, how

you load the dishwasher and finally, pre-rinsing is optional

depending on the dishwasher

Same with the washing machine, fill up the machine, add soap, and

turn on the machine. Better results happen with a little bit of

sorting by clothing type or color.

The washing machine will wash either way. Yhe clothes will come out clean. The unanswered question until the load is done is: Will the T-shirt still be white? Are the colored clothes the same exact color as when they went into the washing machine?

Many Contractors Practice The Keep It Simple Method For Bookkeeping

Put all of the receipts in the drawer. Out of sight and out of

mind. The drawer is next to the computer with the QuickBooks for

Contractors or other Bookkeeping Software on it.

Using the power of Wishful Thinking; the hope is that the

transactions will “Magically Appear” into the Bookkeeping software

without any additional assistance from them.

Unfortunately, with all of the technology available; it still

requires the help of a “Real Person” with skills to know where to

put the transaction into the system.

Does Income Exceed Outgo? – Short Answer Yes, there is still money

in the bank, and ALL of the bills are paid. Do Problems Come From

Not Knowing What To Do?

The bank only knows what has been

deposited, what has cleared and the balance left in the account.

Without an accounting system that tracks all of the income and

expenses, How Do You Know? It is easy to put everything on

Auto Pay and forget it.

Unfortunately, your clients have higher expectations and may not be

willing to pay you based on when your auto-pays will be coming out

of the checking account. Throw enough money in the checkbook, and

everything will be ok – Right?

In the short term, all is great. It is called “Robbing Peter To Pay

Paul.” In other words, you are paying yesterday’s bills with

tomorrow’s money. This works perfectly when the economy is booming,

and work is plentiful. You can take that job deposit and go to the

nearest Truck Dealership and buy a New Truck.

Money is coming in fast like a spring thaw; no end in sight. No big

deal with supplier bills or subcontractor being paid twice. There

is enough money for everyone.

Unfortunately, that was not the way it works forever. Outside

forces can cause the world of Construction to go from a Boom to a

Bust in minutes, and recovery usually takes longer than a few days.

For

Example

Weather related Floods, Hurricanes, Earthquakes, Avalanches, Mud

Slides, No Snow, Too Much Snow. Bridges crash for a variety of

reason. All of these things can cause Major Interstates to be

closed.

Other economic factors can cause businesses to lay off workers or

close. High fuel prices and everyone stays home. I remember waiting

in Long Lines to be able to “get gas.” Your day depended on the

last digit of your license plate. About that same time, it seemed

like Houston, Texas would be a “ghost town” forever.

In 1971 there was a billboard in Seattle and had “Would the last

person leaving SEATTLE - Turn out the lights” and look at it now.

Downtown is dense, full of skyscrapers, building projects

everywhere and lots of traffic.

Construction Contractors Face Challenges of Feast

and Famine Depending On Your Local Area

The last few years in many areas of the country has been extremely tough on Construction Contractors. Some areas became the New Boom Towns while other areas declined or stayed the same (no growth and limited decline)

- Contractors adapted what they did, and whom they worked for and survived.

- Contractors were financially able to close shop and weather the storm.

- Contractors went back to work as employees of other contractors

- Contractors changed professions

- Contractors changed lifestyles

- Contractors retired

The economy is picking up in many areas of the country the need for contractor bookkeeping increases.

Contractors are going back to work. Able to charge reasonable

prices (versus cutting bids just to keep working) For a long time;

it was very depressing for Contractors to look at numbers when they

know there is limited money for personal.

All income going back into

the business in the form of tools, trucks, equipment and material

for the job:

- Hoping the get by without any major truck breakdowns.

- Hoping that the weather would be good and the jobs would keep coming in.

- Hoping to get back to the part of Construction the Contractor likes to do and not just what it takes to keep going.

- Many contractors took on additional businesses or business types just to be able to keep going

- Many of these 2nd and 3rd businesses were not directly related to their primary business.

- They found a “Need” and “Filled It” and made a little extra money along the way.

- Most New Construction Builders do not want to do a Custom Home Project

- Most Custom Home Builders do not want to do Large Additional Projects

- Most General Contractors do not want to do Small Remodel Projects

- Most Remodel Contractors do not want to do Handyman Projects

- Most Trade Contractors do not want to do more then (1) trades unless it is related.

The Common trait for all these contractors is

that “Contractor Did What Was Needed To Provide For Their

Family.”

Contractors did their own

bookkeeping. Spouses helped with Bookkeeping, Paying Bills, and

Answering Phone.

Many spouses are

“self-taught” because it didn’t matter if the training was

available; there was No Money.

Now both Contractors and their Spouses want to know:

- Are We Making Money Or Losing Money?

- Is that “5 Cents” in the checkbook Our Money to spend as we please?

- Is that “5 Cents” in the checkbook already spent and the check has not been entered?

- Is that “5 Cents” due to a supplier or for some other bill coming I don’t know about yet?

- Does the “5 Cents” belong to The Government (Local, State, Federal) in taxes I don’t know about?

We Are Here To Help – We Know What To Do – You Do Not Need To Train Us To Do Our Job

We have a Customized Setup for the QuickBooks Desktop

Version and process that make it simple for you

to come on-board. We know what works.

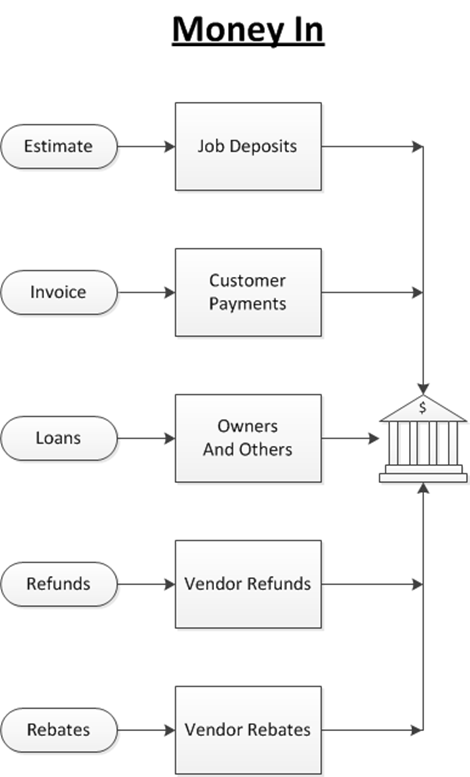

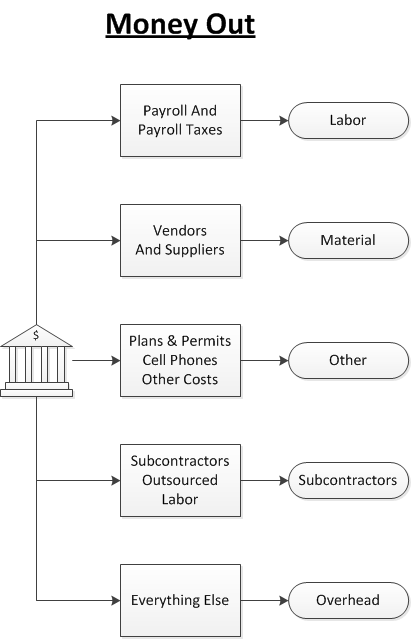

Our System Is A We Process

- As the Client, you still do the parts that only

you can (and should do) Meet Your Customers, Create Bids, Create

Invoices, Collect The Money, Pay The Bills.

Our Part -

Putting all those Transactions in QuickBooks in a way that produces

useful reports for You and Your Tax Accountant. Your Tax Accountant

looks at your numbers (1) day per year.

You Part - Is

you have to live The Good, The Bad, and The Ugly and all their

consequences the other 364 days of the year. As a Contractor,

you have to make decisions every day.

We Are Here To

Help - We Know What You Need and Why You Need

It.

Starting Where You Are Now

- We can clean up your QuickBooks file (Desktop Version) and get it current.

Starting With Yesterday

- We can clean up your QuickBooks file going back as many years as you want.

Looking At Tomorrow

- We can provide Ongoing Bookkeeping Services.

- Part of that service is reconciling the checkbook, entering invoices, receiving payment.

- All of these things (and more) lead to having good Financial Reports.

With better QuickBooks Reports, you can make better decisions.

Have More Time to do the things you want to do with your Life,

Family, and Friends.

Looking Forward To Getting Started

Enjoy Your Day.

Sharie

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

We Remove Contractor's Unique Paperwork Frustrations

We understand the good, bad and the ugly about owning and operating construction companies because we have had several of them and we sincerely care about you and your construction company!

That is all I have for now, and if you have listened to this far please do me the honor of commenting and rating podcast www.FastEasyAccounting.com/podcast Tell me what you liked, did not like, tell it as you see it because your feedback is crucial and I thank you in advance.

You Deserve To Be Wealthy Because You Bring Value To Other People's Lives!

I trust this will be of value to you and your feedback is always welcome at www.FastEasyAccounting.com/podcast

One more example of how Fast Easy Accounting is helping construction company owners across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to construction contractors like you so stop missing out and call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

Contractor Bookkeeping Done For You!

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Link Below:

This guide will help you learn what to look for in outsourced construction accounting.

Need Help Now?

Call Sharie 206-361-3950

Thank you very much, and I hope you understand we do care about you and all contractors regardless of whether or not you ever hire our services.

Bye for now until our next episode here on the Contractors Success MAP Podcast.

Warm Regards,

Randal DeHart | The Contractors Accountant

Our Workflow Removes Your Paperwork Frustrations

For Contractors Who Prefer

To Do Your Bookkeeping

Fast Easy Accounting

Do-It-Yourself

Construction Accounting Store Is

Open

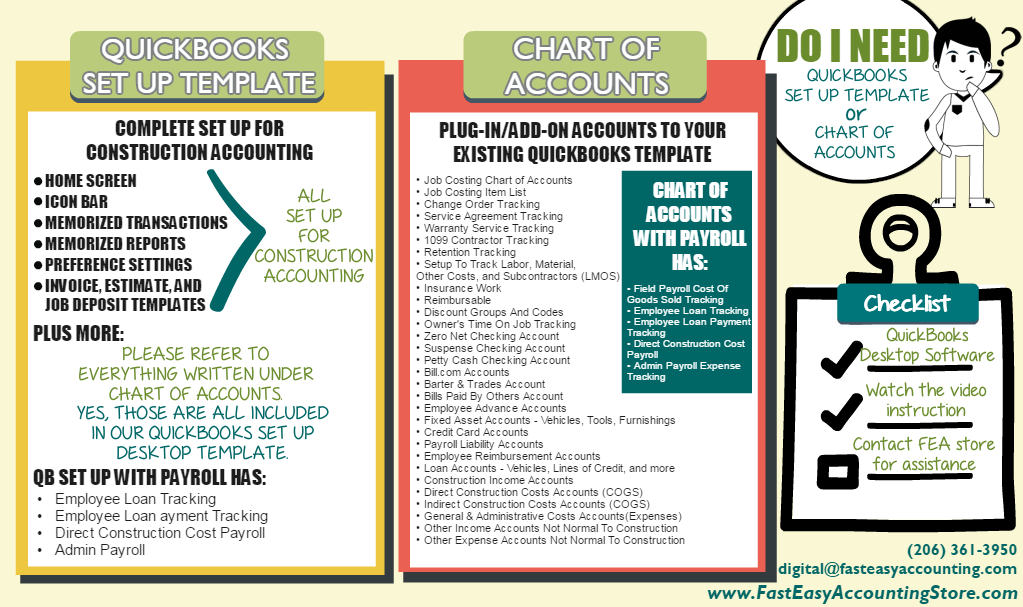

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Contractors_Success_MAP, Contractors_Success_Marketing_Accounting_Production, Contractor_Bookkeeping_Services, QuickBooks_For_Contractors, QuickBooks_For_Contractors,Contractors Messy Bookkeeping Issues Solved