Jun 16, 2017

This Podcast Is Episode Number 0221 And It Will Be About Contractors of all sizes must be adaptable to change

Every time the phone rings you need to be willing to question

what do they need are how far are you willing to drive to bid the

job and do the work. Some types of work accepted or rejected may be

based on the location of the job or by the state license.

When starting out one of the first decisions to be made is “What

Type Of Contractor Am I?” This decided during the process of the

contractor talking to the Bonding Company, Insurance Company and

The State Licensing Board who approves the company’s Contractors

License.

The Primary Questions to be

answered are:

- What level of exposure, risk and your skills?

- How do you want to do these projects?

- Are you most comfortable being a Handyman?

- Are you most comfortable being a Trade or Specialty Contractor?

- Are you most comfortable being a General Contractor?

- Are you most comfortable being a Remodel Contractor?

- Are you most comfortable being a Home Builder?

The Four Types Of Contractors...

Dog And Pick-Up Truck

This Wonderful Soul - Has a heart as big as the outdoors and likes working alone. They are easy to get to know. They usually have either a pick-up truck or a van with a dog sitting in the passenger seat hanging his head out the window watching and occasionally barking hello to folks and other dogs while feeling the breeze as the contractor zooms down the road.

They Do Not Think About - Retirement and when asked about

it the reply I get most often is something

like “Retire, nope, I don’t need new tires yet”.

These Contractors - Enjoy being their own boss, doing what they

want when they want, how they want and works hard. They typically

do not feel the need or desire to grow the business or hire

employees since they would only get in the way.

Most Of Them - Run their business as a sole proprietor

They Generally Earn - $20K to $40K a year after all expenses

Salt of The

Earth

This Wonderful Soul - Also has a big heart; just not quite as big

as all outdoors. They like having employees because they do not

want to work alone. As their business grows they like to take

time off and enjoy travel and vacations.

These Contractors - Have one, two or three employees because when the employees get out of line the contractor can hold two of them by the throat; one in each hand and eyeball the third one! This is called “Construction Management”

This Group Will Usually Invest - Some money to build a

retirement nest egg.

Most Of Them - Operate their business as a C-Corporation, LLC or

Sub-S

They Generally Earn - $40K to $60K a year after all expenses

The

Professional

This Wonderful Soul - Also has a big heart; they just tend to keep it under cover. This group tends to have more employees and have a structured approach to their construction company treating it more like a firm.

These Contractors - Tend to have 1-20 employees with formal organizational charts, processes, and systems in their contracting businesses including a formal documented business plan which is updated and reviewed regularly with a board of advisors as outlined in my article on the subject.

They Invest Heavily In Marketing - Their businesses. They understand their target market, they use The 80/20 Rule to understand the demographics and psychographics of their prime customer, the ones who generate 80% of the cash and income. And they seek to acquire more of them and will do whatever is economically feasible to turn those customers into lifetime repeat business.

This Group Usually - Engages the services of a competent financial planner, banker, and accountant to work together in helping plan and develop a financial estate that can take care of them in their senior years and be passed on to future generations.

Most Of Them - Operate as a C-Corporation, LLC or Sub-S or

Partnership.

They Generally Earn - $100,000+ a year after all expenses

The Enterprise

Level

These Construction Firms - Have 100+ employees and generate enormous revenues. Most of the owners and managers earn about the same as a well-run professional contractor. In a lot of cases, their life span is shorter than any of the other contractors due to the enormous stress they suffer trying to navigate their construction companies through the ups and downs of the Business Cycle.

The Managers Deal With Issues - That are beyond anything the previous groups even think about, including labor unions, government oversight, massive risk and are constantly under pressure to increase shareholder value at any cost.

Seagull Management - All too often a board member or powerful outside influence without a clear understanding of all of the moving parts involved in running this type of company feels the compelling need to fly in, crap on everything and everyone with their crazy ideas and fly out leaving a disaster to unfold. Then when things go bad the managers are the ones most likely to pay the price.

The Odd Thing Is - It always looks like a fun job until someone gets into it. Having worked with a few of these firms I understand the enormous pressure they are under and have decided my life is too short to spend one more minute with them. All I can do is pray for the managers and ask that all of them will receive divine guidance to stop them from making a long-term decision like suicide or worse, based on short-term problems.

I Am Sincerely Concerned - About the health, wealth and

spiritual well-being of all contractors and have found the other

three types of contractors to be well grounded spiritually;

however, since I am aware of the special challenges of running an

enterprise construction company I sincerely ask you as a friend;

someone you may not have met, and may never meet on this plane of

existence, that you will seek the goodness of an everlasting and

ever loving God, whatever you conceive him to be, so we can meet in

the future in a better time and a better place.

If You Are A Contractor - It is not about the type of contractor

you are, how many employees you have or how much money you earn. It

is all about life, liberty and the pursuit of happiness. Be the

type of contractor that suits you, do the work, you will

have results and enjoy yourself.

The Final Observation - I will share is that you deserve to be

wealthy because you bring value to other people's lives and do not

let anyone tell you differently.

The rules for contractors vary by state. In several states, it is

the size of the job that dictates the type of license is required.

(Everyone can start out as a Handyman and work up to being a

General Contractor). Specialty licenses are required for Plumbers,

Electricians, and others. Again – Plumbers and Electricians start

out as “apprentices” and work their way up to “Journeyman

status”

What Type of Construction

Work Do You want To Do?

- Residential

- Commercial

- Tenant Improvements

- Service and Repair

- New Construction

- Remodels

Once a contractor figures out “What he or she wants “To Do” the next step is consulting your State Requirements” (and skills).

Next Decision: “Where Do You Want To Do It?” (Location, Location, Location)

- Big City

- Medium City

- Bedroom Community

- Large Town

- Small Town

- In the Country

In a small town, you usually have to travel farther to the jobs. In a big city – it is not practical to spend hours of windshield time versus choosing closer jobs. In bad traffic, the travel time could be the same.

Travel Time is part of

overhead and Not Billable To The Customer.

- How far do you want to travel?

- How far away will you drive to get to the job?

- How long are you willing to be “stuck” in traffic?

Choosing the time of day can be as important as choosing where

to travel.

Watching the news this morning it was saying between two cities

(Seattle area) southbound on the freeway travel time was 82

minutes. Northbound between same two cities travel time was 23

minutes.

When a call comes in – you are for lack of a better term. “On the

Hot Seat.” You want to say Yes, I will come to no matter what or

where the job is. The reality that may not be practical. You are

always doing a fast filter trying to decide to get more information

about the job or have enough information to let it go.

Are you skilled to do what

the customer would like?

- Is the job something you normally do?

- Is the job the right size of job?

- Where is the job located?

If you have just finished a job and a neighbor down the street of that job comes over and asks you to come look. You are more likely to “Say Yes” I will see you next because you are right there. A small job might have the potential of becoming a larger project (you won’t know unless you go look).

Even if the job is much smaller than what you usually accept.

Again, you are more likely to “Say Yes” because you are right

there. If that same person called and you were on a job 82 minutes

away in bad traffic you may have a different

answer.

Just starting out as a contractor. Then you will more than likely

be more willing to take on all sizes of jobs. Contractors in

smaller towns “Do A Little Bit Of Everything” from service and

repair on leaky faucets to kitchen and bath remodels, to whole

house remodels, to tenant improvements and new construction.

Why are they so flexible? It is because the work is not so

plentiful that they need to have a broad skill base and willingness

to work on almost anything to make a “decent living.”

In the bigger city, they would be a “General Contractor.” In a

smaller community, it is called being a “Generalist”.

A word of caution about working for almost exclusively for a single

contractor.

Seems easy; if there is lots of work coming in, I’m asked “Why do I

want to work for other contractors?

Short Answer: Taxes and Penalties. Every State Government (Worker’s

Comp | State Unemployment) is looking for additional Tax Revenue.

If you are working for a single contractor The State may classify

you as an Employee. The penalty is issued and payroll taxes are

due. Do what I call: Playing Within The Lines!

Explanation From Taxing Agency: Is that you have a Contractor’s

License only to avoid payroll taxes

Of course, once a State Agency determines you are an employee, the

IRS will also want payroll taxes.

The downside of working for a single contractor. Everything is

great as long as you are getting along.

What is the contractor suddenly doesn’t like you, decides to

discount your invoices, refuses to pay you?

You could go from a situation where you have a stable contact

situation to Oh Crap – Now What Am I going to do?

I recommend all small contractors (especially those who work

primarily as a trade contractor) to find several General

Contractors to work for as your primary source of income. Now –

next step find other retail customers. Work your neighborhood, the

neighborhood of existing and previous jobs. If you have only small

bits of time – Great look for small jobs. Help the senior citizens

in the neighborhood.

Why – you are looking to increase your customer base

(headcount).

Need to document that you are NOT working for a Contractor of One.

Ask for referrals of other contractors. Everyone has jobs that are

“Too Big” or “Too Small.”

Working together with other General and Trade Contractors to find

customers you can avoid being classified as an employee by a State,

Local, Federal Government Agencies.

Another part of the rules to document you are operating a “real

business” Advertise. Have a website, get business cards, hand out

flyers.

The next piece is to have an “outside accountant” (who has a

business license). Again you are documenting you are in business

and not working “under the table” as a 1099 employee.

Think, Save a Little, Plan a Lot. The economy always has peaks and

valleys. No one expected the last recession to last as long as it

did or impact as many people. Contractors were hit the hardest

because it was a domino effect. Banks stopped lending; called loans

due. Contractors couldn’t pay or get paid.

Many former contractors are just now thinking about going back into

the construction business. In a former life, they had lots of

employees and a full accounting staff. In many cases, contractors

were left with HUGE debts and long-term payment plan to the IRS. I

hear more from Contractors who “Had Issues” over Contractors who

sold everything and have been “Coasting Nicely” these last few

years.

Some Contractors who are starting over just want a “Little Help.”

For them, gone are the days of High-End Accounting Software and a

huge payroll. The High-End Accounting Software still exists.

Contractors love the price of an under $500.00 one time cost

accounting software but they may struggle with having to make the

choice of having “fewer Reports” to work with.

What is not there is The Contractor who remembers the Pain of

Yesterday having the willingness to immediately “Step Up and

Purchase” expensive Accounting Software. When starting over – Going

back to where these Larger Contractors were before is usually not

the first choice and may not be feasible from a credit or cash flow

standpoint.

Others are downsizing from Specialty Accounting Software to

QuickBooks Desktop Accounting Software.

Another change I see is that contractors are looking for more

Specialty Trade Contractors where before it was all “In-House

Employees.”

As a Contractor, you want to get paid easier and faster. The answer

is to have a Stand Alone Invoice or Web-based invoice that is easy

to understand. Builders, General Contractors, and Homeowners just

want to be able to easily understand your invoice and pay you.

Customers want to pay using their credit card.

The harder is for the Customer to understand what’s due the longer

it takes to get paid.

Have you laid out a payment schedule? Is it Due on

Completion, By Date or By Milestone of the Project?

No one likes to receive a “story problem” where they have to figure

out How Much To Pay You.

An example is using a “Long Winded Email” as an Estimate, Proposal,

Invoice and Payment Receipt.

Yes – We Can Help! We Setup QuickBooks for more than 100 types of

Contractors, enter in previous accounting from a mutually agreed

date, continue with ongoing Bookkeeping needs. Use QuickBooks

Desktop in a cloud environment, it is optional that our clients

have access to the QuickBooks file. With our processes and other

add-on software, we make it easy for our clients to send, access

documents and reports.

Short List Construction Contractors We Serve

Brand New Construction Company Handyman Company

Cabinet Installer HVAC Contractor

Carpentry Contractor Insulation Contractor

Carpet And Tile Contractor Interior Designer

Commercial Tenant Improvement Contractor Land Development Company

Concrete Contractor Landscape Contractor

Construction Company Masonry Contractor

Construction Manager Mold Remediation Company

Contracting Company Moss Removal Company

Contractor Painting Contractor

Custom Deck Builder Plumbing Contractor

Custom Home Builder Pressure Washing Company

Demolition Contractor Remodel Construction Company

Drywall Contractor Renovation Contractor

Electrical Contractor Restoration Contractor

Emerging Contractor Roofing Contractor

Excavation Contractor Spec Home Builder

Finish Millwork Contractor Specialty Contractor

Flipper House Contractor Subcontractor

Flooring Contractor Trade Contractor

Framing Contractor Underground Contractor

General Contractor Utility Contractor

Glass Installation Contractor Construction Employees

Gutter Installation Company Construction Support Specialist

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up Templates

Solopreneur

QuickBooks Chart Of Accounts

Free Stuff

QuickBooks Item Lists Templates

Consulting

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

Other clients after their QuickBooks file is setup choose to

stay on the Cloud Server, do their own bookkeeping and request an

additional accounting, bookkeeping and consulting assistance as

needed.

To be better able to assist, we have added our

FastEasyAccountingStore for the convenience of clients who want to

do their own bookkeeping and need additional Chart of Accounts and

Items Lists to make their QuickBooks File work more efficiently.

Looking forward to being of assistance.

Enjoy your day.

Sharie

I trust this podcast helps you understand that outsourcing your contractor's bookkeeping services to us is about more than just “doing the bookkeeping”; it is about taking a holistic approach to your entire construction company and helping support you as a contractor and as a person.

We Remove Contractor's Unique Paperwork Frustrations

We understand the good, bad and the ugly about owning and operating construction companies because we have had several of them and we sincerely care about you and your construction company!

That is all I have for now, and if you have listened to this far please do me the honor of commenting and rating podcast www.FastEasyAccounting.com/podcast Tell me what you liked, did not like, tell it as you see it because your feedback is crucial and I thank you in advance.

You Deserve To Be Wealthy Because You Bring Value To Other People's Lives!

I trust this will be of value to you and your feedback is always welcome at www.FastEasyAccounting.com/podcast

One more example of how Fast Easy Accounting is helping construction company owners across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to construction contractors like you so stop missing out and call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

Contractor Bookkeeping Done For You!

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Link Below:

This guide will help you learn what to look for in outsourced construction accounting.

Need Help Now?

Call Sharie 206-361-3950

Thank you very much, and I hope you understand we do care about

you and all contractors regardless of whether or not you ever hire

our services.

Bye for now until our next episode here on the Contractors Success

MAP Podcast.

Enjoy your day.

Sharie

About The

Author:

![]() https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

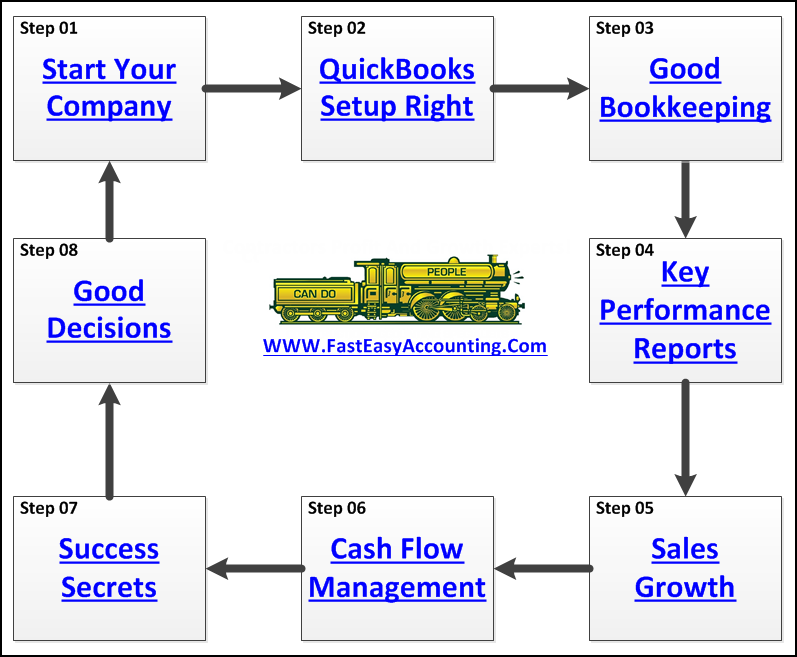

Our Workflow Removes Your Paperwork Frustrations

For Contractors Who Prefer

To Do Your Bookkeeping

Fast Easy Accounting

Do-It-Yourself

Construction Accounting Store Is

Open

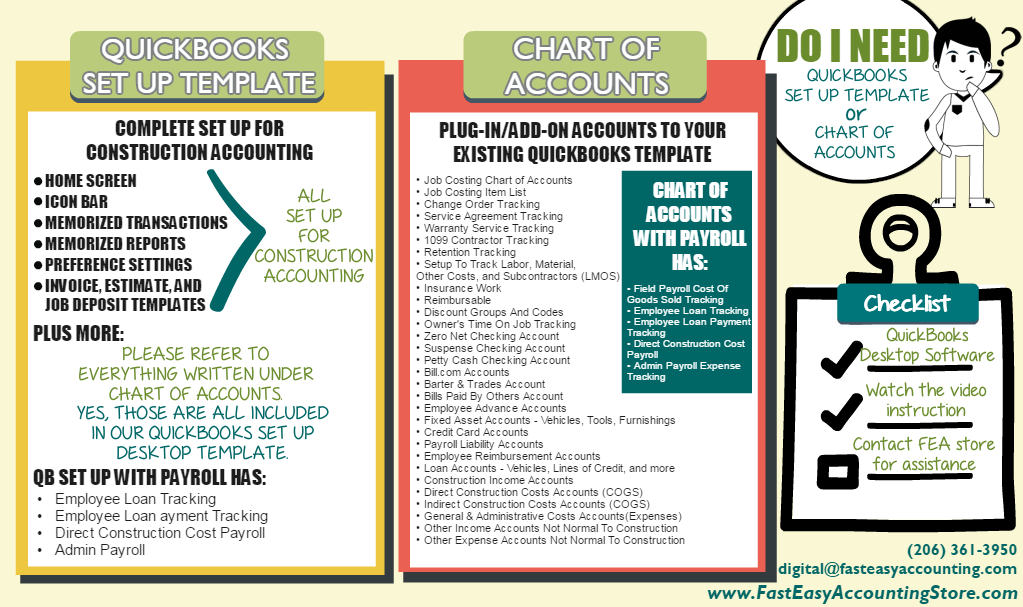

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Short List Construction Contractors We Serve

Brand New Construction Company Handyman Company

Cabinet Installer HVAC Contractor

Carpentry Contractor Insulation Contractor

Carpet And Tile Contractor Interior Designer

Commercial Tenant Improvement Contractor Land Development Company

Concrete Contractor Landscape Contractor

Construction Company Masonry Contractor

Construction Manager Mold Remediation Company

Contracting Company Moss Removal Company

Contractor Painting Contractor

Custom Deck Builder Plumbing Contractor

Custom Home Builder Pressure Washing Company

Demolition Contractor Remodel Construction Company

Drywall Contractor Renovation Contractor

Electrical Contractor Restoration Contractor

Emerging Contractor Roofing Contractor

Excavation Contractor Spec Home Builder

Finish Millwork Contractor Specialty Contractor

Flipper House Contractor Subcontractor

Flooring Contractor Trade Contractor

Framing Contractor Underground Contractor

General Contractor Utility Contractor

Glass Installation Contractor Construction Employees

Gutter Installation Company Construction Support Specialist

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up Templates

Solopreneur

QuickBooks Chart Of Accounts

Free Stuff

QuickBooks Item Lists Templates

Consulting

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

If you are a blogger, who writes about construction we would like to hear from you.

https://www.fasteasyaccounting.com/guestblogger

Contractors_Success_MAP, Contractors_Success_Marketing_Accounting_Production, Contractor_Bookkeeping_Services, QuickBooks_For_Contractors, QuickBooks_For_Contractors,Contractors_Success_Map_Highly_Profitable_Contractors_Continually_Adapt_To_change