Aug 3, 2018

This Podcast Is Episode Number 0280, And It Will Be About Unique Contractor Bookkeeping Problems With Receivables

Challenges Of Keeping Accounts Receivable Simple And Up To Date

Creating an invoice for the entire project seems like it is the simple way to track payments and have the current balance. The harsh reality is that if all of the work is NOT done Accounts receivable is reflecting a balance due that is NOT REAL.

With Change Orders to the projects (up or down), the original contract is usually not the end number. Accounts receivable is a reflection of money you expect to collect NOW.

More extensive projects (especially new construction) the billing and payment schedule typically is a bill on the 25th of the month and hope to be paid on or before the 10th of the following month. Anything not paid is going to age on the Accounts Receivable (A/R) Aging Summary.

Job Deposits, Retention, Notes Receivable (long-term payment plans) are not part of Accounts Receivable. Credits from suppliers, repayment of Loans to Owners, Employees, Friends, and Family do not belong in Accounts Receivable. Follow up as necessary for payment but Accounts Receivable is for expected Income from Customers and clients for work performed.

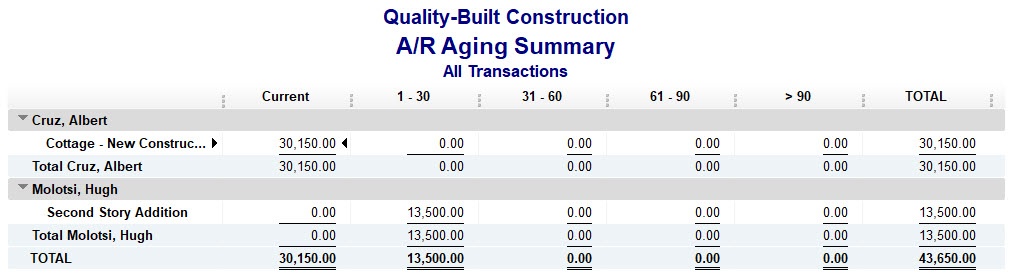

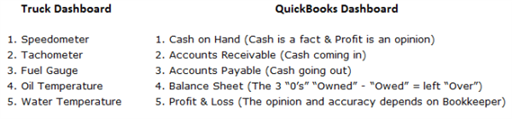

Accounts Receivable (A/R) Aging Summary

Is Like The Tachometer On Your

Vehicle

Do you have numbers in Current, 1-30, 31-60, 61-90, >90? What is your Total? Reminder you have already paid your Labor, Material, Other Costs, Subcontractor, Taxes on all this money. Every dollar sitting there is a big deal. Your contractor (as a sub) may be pay as paid and you might have that same agreement with your subcontractors, but your supplier has been paid or will expect to be NOW!

Reminder – You should be collecting Job Deposits

Do Not Borrow Money

On Your Credit Card At 18% And Lend It At

0%

You Are Not A Bank - Never use your high interest credit cards and supplier accounts to provide financing to your customers in the form of providing a lot of labor, material, subcontractors and rental equipment hoping to get paid later on down the road.

McDonald's Restaurants Earns - Massive profits and part of the reason is cash flow. I love their business model; customers order first, pay second and get food last. No invoicing, no waiting for the check to arrive and hoping it will clear the bank. They say just Show Me The Money!

You Can Offer Financing - Accept credit cards! Get setup at a bank and/or credit union that will offer to loan your construction client's money for small projects under $25,000. They sign paperwork with the lender; you do the work and get paid.

Accepting Credit And Debit Cards - is like having an "Electronic Armored Car" on standby 24 hours a day, seven days a week ready to take your money to your bank automatically. If your QuickBooks is setup properly an invoice can be emailed to your customer or clients and when they open it there is an option for them to pay by credit card immediately.

For Example - You finished a construction project at 01:00PM, went to your office at 05:00PM, opened QuickBooks, put together an invoice and emailed it to your customer at 06:00PM. They arrive at home at 07:00PM. After dinner they check their email at 09:00PM. They open your email review your invoice and pay the bill at 10:00PM.

Don't Ever Finance - Your customer or client's project by providing substantial amounts of labor, material, subcontractors and rental equipment hoping to get paid later down the road.

Having Owned And Operated - Several construction businesses I know how important cash flow is to the success or failure of any business and especially construction companies like yours!

We Have Clients - Who took a while to understand why I was hard on them and kept saying "Get The Money". Once they realized what real peace of mind was, paying all the bills on time and having money left over for vacations, toys and to support their favorite charities it became crystal clear.

Get Enough Job Deposits - And progress payments so that you are always using "Other People's Money" (O.P.M.) to pay for the labor, material, subcontractors, rental equipment and overhead of their construction projects.When you invoice your customer for the entire amount of the job it makes it very hard to keep track of the unbilled portion because as change orders occur (up or down) the amount due to changes. Then the contractor is trying to figure out what the current billing is due outside of QuickBooks.

Creating a double billing will then run the risk of overstating income, being liable for and paying taxes on a number that is not real. Cleaning up the QuickBooks file, we find contractors will have entered into QuickBooks an Estimate as an Invoice based on their best hope that the Yes from their customer is real.Unable paid balances in Accounts Receivable Aging Summary can be as simple as sales tax adjustment, payment received and no invoice was created.

Slight overpayment where client rounded up payment for convenience (tip). Other times payment was posted directly to the checking account, paid into Paypal (then a different amount transferred to checking) or money received was less due to merchant services fees.

All over the course of time will distort the numbers. You the Contractor looking at the Balance Sheet and say "I can buy [fill in the blank] because I have this much in Accounts Receivable". The banker looks at the Accounts Receivable and wonders why you cannot or won’t collect the balance due. Many tax accountants suggest any amounts over 90 days should be written off. Lots of bad debts are not helpful in getting loans from the bank. Again negative numbers and low balances are invoicing issues. Large balances are sometimes the result of a number billed ahead of work performed or a result of a poor contract or collection policy.

Taking credit cards is cheap in comparison to penalties and late fees, especially to State and Federal Government. The question you could ask yourself is paying 2% discount less than paying 18% or more in fines and penalties?

In Conclusion:

Helping Contractors around the world

is one of the reasons we added the FastEasyAccountingStore.com

Follow our blogs, listen to Contractor Success M.A.P. Podcast. We Appreciate Our

Visitors, Listeners, and Subscribers. – Thank You!!

Download The Contractors APP Now!

Access code: FEAHEROS

The QR Code Below Will Go

Apple Or Android Store

Whichever One

You Need

Simply scan the QR code below or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7.

Access code: FEAHEROS

Or click to download the Contractors APP now from the App or Android store

Click here to download the App on iOS:

Click here to download the App on Android:

We are here to Help “A Little or A Lot” depending on your needs.

About The

Author:

![]()

https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

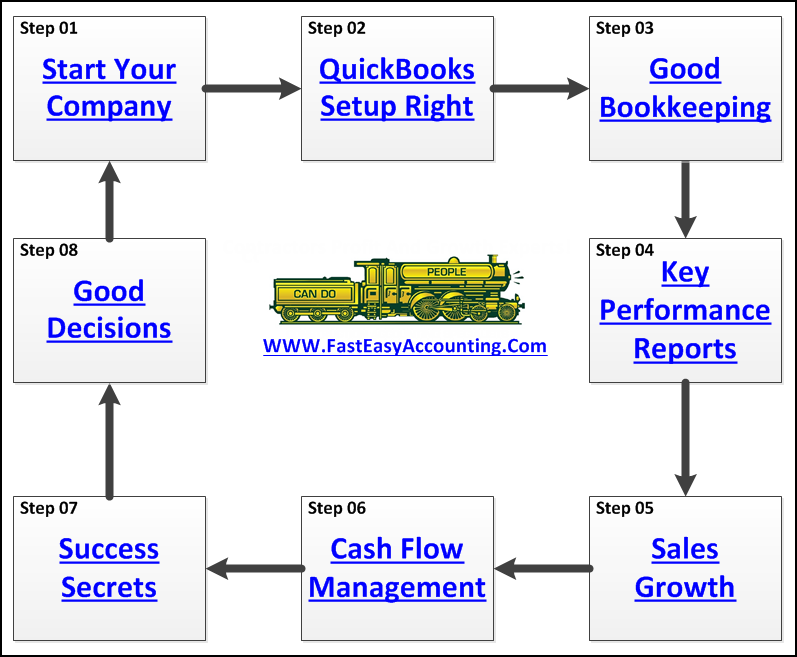

I trust this podcast helps you understand that outsourcing your contractor's bookkeeping services to us is about more than just “doing the bookkeeping”; it is about taking a holistic approach to your entire construction company and helping support you as a contractor and as a person.

We Remove Contractor's Unique Paperwork Frustrations

We understand the good, bad and the ugly about owning and operating construction companies because we have had several of them and we sincerely care about you and your construction company!

That is all I have for now, and if you have listened to this far please do me the honor of commenting and rating the Podcast www.FastEasyAccounting.com/podcast Tell me what you liked, did not like, tell it as you see it because your feedback is crucial and I thank you in advance.

You Deserve To Be Wealthy Because You Bring Value To Other People's Lives!

I trust this will be of value to you and your feedback is always welcome at www.FastEasyAccounting.com/podcast

This Is One more example of how Fast Easy Accounting is helping construction company owners across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to construction contractors like you so stop missing out and call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com

Contractor Bookkeeping Done For You!

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Link Below:

This guide will help you learn what to look for in outsourced construction accounting.

Need Help Now?

Call Sharie 206-361-3950

Thank you very much, and I hope you understand we do care about

you and all contractors regardless of whether or not you ever hire

our services.

Bye for now until our next episode here on the Contractors Success

MAP Podcast.

Enjoy your day.

Sharie

About The

Author:

![]() https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

https://www.fasteasyaccounting.com/free-one-hour-consultation-bookkeeping

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Our Workflow Removes Your Paperwork Frustrations

For Contractors Who Prefer

To Do Your Bookkeeping

Fast Easy Accounting

Do-It-Yourself

Construction Accounting Store Is

Open

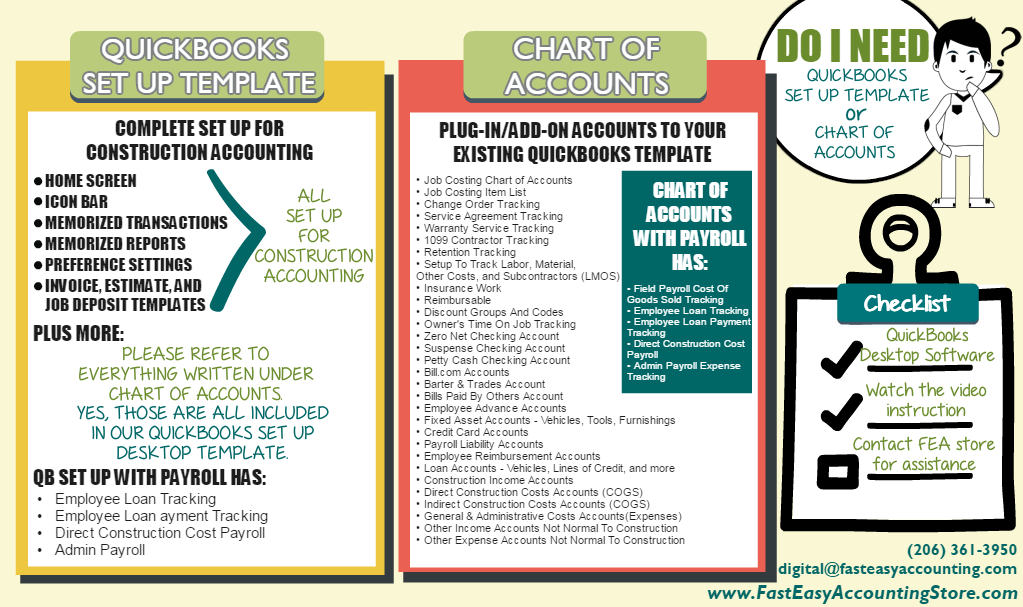

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Short List Of Construction Contractors We Serve

Asphalt ContractorAsphalt Contractor Brand New ContractorBrand New ContractorBrick And Stone ContractorBrick And Stone ContractorCabinet Installation ContractorCabinet Installation ContractorCarpentry ContractorCarpentry ContractorCarpet And Tile ContractorCarpet And Tile ContractorCommercial Tenant Improvement ContractorCommercial Tenant Improvement ContractorConcrete ContractorConcrete ContractorConstruction EmployeesConstruction EmployeesConstruction ManagerConstruction ManagerConstruction Support SpecialistConstruction Support SpecialistCustom Deck ContractorCustom Deck ContractorCustom Home BuilderCustom Home BuilderDemolition ContractorDemolition ContractorDrywall ContractorDrywall ContractorElectrical ContractorElectrical ContractorEmerging ContractorEmerging ContractorExcavation ContractorExcavation ContractorFinish Millwork ContractorFinish Millwork ContractorFlipper House ContractorFlipper House ContractorFlooring ContractorFlooring ContractorFoundation ContractorFoundation ContractorFraming ContractorFraming ContractorGeneral ContractorGeneral ContractorGlass Installation ContractorGlass Installation ContractorGutter ContractorGutter ContractorHandyman ContractorHandyman ContractorHot Tub ContractorHot Tub ContractorHVAC ContractorHVAC ContractorInsulation ContractorInsulation ContractorInterior Designer ContractorInterior Designer ContractorLand Development ContractorLand Development ContractorLandscape ContractorLandscape ContractorLawn And Yard Maintenance ContractorLawn And Yard Maintenance ContractorMasonry ContractorMasonry ContractorMold Remediation ContractorMold Remediation ContractorMoss Removal ContractorMoss Removal ContractorPainting ContractorPainting ContractorPlaster ContractorPlaster ContractorPlaster And Stucco ContractorPlaster And Stucco ContractorPlumbing ContractorPlumbing ContractorPressure Washing ContractorPressure Washing ContractorRemodel ContractorRemodel ContractorRenovation ContractorRenovation ContractorRestoration ContractorRestoration ContractorRoofing ContractorRoofing ContractorSiding ContractorSiding ContractorSpec Home BuilderSpec Home BuilderSpecialty ContractorSpecialty ContractorStone Mason ContractorStone Mason ContractorStucco ContractorStucco ContractorSubcontractorSubcontractorSwimming Pool ContractorSwimming Pool ContractorSwimming Pool And Hot Tub ContractorSwimming Pool And Hot Tub ContractorTile And Carpet ContractorTile And Carpet ContractorTrade ContractorTrade ContractorTree ContractorTree ContractorUnderground ContractorUnderground ContractorUtility ContractorUtility ContractorWaterproofing ContractorWaterproofing ContractorWindow ContractorWindow Contractor

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up TemplatesSolopreneurQuickBooks Chart Of AccountsFree StuffQuickBooks Item Lists TemplatesConsulting

We Serve Over 100 Types Of Contractors So If Your Type Of

Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

Additional QuickBooks Templates, Resources, And Services

QuickBooks Set Up

Templates Solopreneur

QuickBooks Chart Of Accounts

Free

Stuff

QuickBooks Item Lists Templates

Consulting

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

If you are a blogger, who writes about construction we would like to hear from you.

https://www.fasteasyaccounting.com/guestblogger

Contractors_Success_MAP, Contractors_Success_Marketing_Accounting_Production, Contractor_Bookkeeping_Services, QuickBooks_For_Contractors, QuickBooks_For_Contractors,Contractors_Success_Map_Unique_Contractor_Bookkeeping_Problems_With_Receivables