Successful contractors understand how and why the business

cycle of construction works through implementing these actionable

steps:

Examine all your processes

Take a long hard look at your construction company and list

all of the recent mistakes, warranty work, rework, and

time-wasters. Then develop a project plan to remove them, one at a

time.

Often your office staff is working with

misinformation:

- a receipt without a job, name, or address (or any note)

which job it goes to

- a bank statement that only shows the date the check

cleared

- the check number and the amount without any information

regarding who it went to, why, or a job name

Office staff believes field workers are lazy and incompetent;

field workers believe office staff is too nosy and wasting field

workers' time. Many times field workers will bring receipts for

material, fuel, permits, or something else they paid for personally

to the office, expecting to get reimbursed immediately. Most of the

time, the paperwork does not have the job name or any authorization

from you or your management team, and the office staff is reluctant

to pay it. Again field workers judge the office staff is trying to

cheat them or at a minimum, playing power-tripping games.

Spend some time with your field workers. Observe how they

perform their work and understand what they do and why they do it.

The number of steps required to mobilize on a job site and get

tools, material, and field workers in place is a process in

itself.

These little delays and setbacks contribute to everyday

misunderstandings, which lead to a massive decline in productivity

and steep deterioration in cash flows and profits. Find and

stop cash flow leaks and profit drains by examining your processes

and walking a mile in the shoes of both office staff and field

workers.

Eliminate paperwork

One of the biggest struggles contracting business owners deal

with is the overwhelming amount of paper they have to organize as

part of their everyday tasks. Invoices, receipts, bills, contracts,

client records, pay applications, insurances, licenses - are just

among the few in the seem to be "never-ending etc." Keeping

important documents is necessary. Most contractors go from one

extreme to the other. One extreme is saving everything for decades,

and the other is tossing everything out.

What to save? What to toss out? At Fast Easy Accounting, we no

longer need to print and save every document in file folders and

keep adding new file cabinets. Our paperwork processes ensure your

happiness and peace of mind knowing that your papers can be

retrieved electronically at any time in the future.

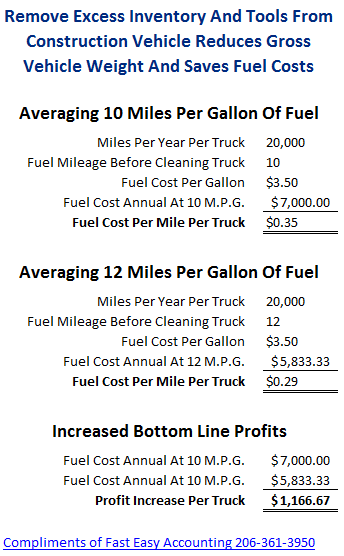

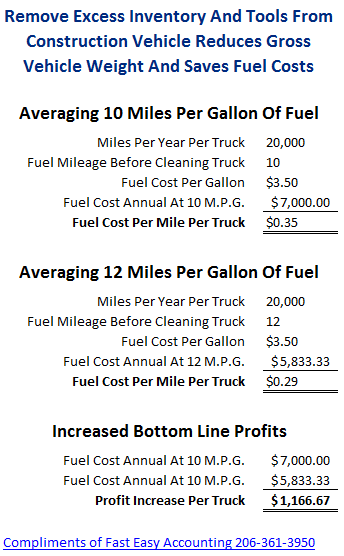

Empty inventory

Empty your trucks and vans, clean out the dirt and grime, and

when you restock, see how much you can leave out. This one thing

can have a massive impact on cash flow and profits. If you can

increase your miles per gallon of fuel from 10 to 12, you will have

increased your earnings from fuel savings by 20%. Let's run the

numbers:

If you stock your truck with

every tool and load it to the sky with all the parts and inventory

you think you may need and drive hard and fast, you are maximizing

that resource, and that is not a good thing.

Benefit -

Hopefully, fewer trips to the supply house, Lowes, Home Depot, or

other places which will save you a little bit of time and

money.

Costs - You will end up spending more money for each mile

you drive because you use more fuel, your brakes will wear out

faster from having to stop with more weight. Your tires will wear

down quicker, and your vehicle suspension parts will need to be

replaced sooner rather than later. You will have money that is tied

up in tools, equipment, and inventory that could be invested

elsewhere and make more money for you. Even worse, if you have any

credit card debt or loans, that money could be used to pay them

down and reduce your interest expense.

Risks

- If you get involved in a

traffic collision and the investigation reveals that you have

exceeded the Gross Vehicle Weight Rating (GVWR) of your truck or

van, then it is likely your insurance may not cover the damages.

Besides, you may be liable for negligence charges. We recommend you

contact your insurance agent and your attorney for their

advice.

In conclusion

The office ensures your contracting company has a steady flow

of projects. Proper accounting and bookkeeping develop timely

financial reports to show which jobs are profitable so you can

pursue more of them, thus, you can focus more on:

- Acquiring the right clients

- Doing the project as close to on-time and on-budget as

possible

- Get job deposits and timely progress payments

- Follow-up with clients to monitor satisfaction and line up new

projects

The key is continuously refining your construction company's

best practices and procedures. Enlightened contractors like you

understand the value of developing your own unique Construction

Contracting System, which is a collection of documented repeatable

processes and operations manuals.

Lost and tired of your bookkeeping system? If you are using

QuickBooks and doing your own books (or have staff doing it for

you), I recommend you head on over to our

Construction Accounting Academy site

and check all the classes available to you immediately. Master the

skills needed to generate useful reports, repeat quality

performances, and make informed decisions to operate and grow your

construction company.

About The Author:

Randal DeHart, PMP, QPA is the

co-founder of Business Consulting And Accounting in Lynnwood

Washington. He is the leading expert in outsourced construction

bookkeeping and accounting services for small construction

companies across the USA. He is experienced as a Contractor,

Project Management Professional, Construction Accountant, Intuit

ProAdvisor, and QuickBooks For Contractors Expert. This combination

of experience and skill sets provides a unique perspective

which allows him to see the world through the eyes of a contractor,

Project Manager, Accountant and Construction Accountant. This

quadruple understanding is what sets him apart from other Intuit

ProAdvisors and accountants to the benefit of all of the

construction contractors he serves across the USA.

Visit http://www.fasteasyaccounting.com/randal-dehart/ to

learn more.

Randal DeHart, PMP, QPA is the

co-founder of Business Consulting And Accounting in Lynnwood

Washington. He is the leading expert in outsourced construction

bookkeeping and accounting services for small construction

companies across the USA. He is experienced as a Contractor,

Project Management Professional, Construction Accountant, Intuit

ProAdvisor, and QuickBooks For Contractors Expert. This combination

of experience and skill sets provides a unique perspective

which allows him to see the world through the eyes of a contractor,

Project Manager, Accountant and Construction Accountant. This

quadruple understanding is what sets him apart from other Intuit

ProAdvisors and accountants to the benefit of all of the

construction contractors he serves across the USA.

Visit http://www.fasteasyaccounting.com/randal-dehart/ to

learn more.

Our Co-Founder Randal

DeHart - Is a Certified PMP (Project Management

Professional) with several years of construction project management

experience. His expertise is construction accounting systems

engineering and process development. His exhaustive study of

several leading experts including the work of Dr. W. Edward Deming,

Michael Gerber, Walter A. Shewhart, James Lewis and dozens of

others was the foundation upon which our Construction Bookkeeping

System is based and continues to evolve and

improve. Check out our Contractor Success Map Podcast on

iTunes.

Randal DeHart, PMP, QPA is the

co-founder of Business Consulting And Accounting in Lynnwood

Washington. He is the leading expert in outsourced construction

bookkeeping and accounting services for small construction

companies across the USA. He is experienced as a Contractor,

Project Management Professional, Construction Accountant, Intuit

ProAdvisor, and QuickBooks For Contractors Expert. This combination

of experience and skill sets provides a unique perspective

which allows him to see the world through the eyes of a contractor,

Project Manager, Accountant and Construction Accountant. This

quadruple understanding is what sets him apart from other Intuit

ProAdvisors and accountants to the benefit of all of the

construction contractors he serves across the USA.

Visit http://www.fasteasyaccounting.com/randal-dehart/ to

learn more.

Randal DeHart, PMP, QPA is the

co-founder of Business Consulting And Accounting in Lynnwood

Washington. He is the leading expert in outsourced construction

bookkeeping and accounting services for small construction

companies across the USA. He is experienced as a Contractor,

Project Management Professional, Construction Accountant, Intuit

ProAdvisor, and QuickBooks For Contractors Expert. This combination

of experience and skill sets provides a unique perspective

which allows him to see the world through the eyes of a contractor,

Project Manager, Accountant and Construction Accountant. This

quadruple understanding is what sets him apart from other Intuit

ProAdvisors and accountants to the benefit of all of the

construction contractors he serves across the USA.

Visit http://www.fasteasyaccounting.com/randal-dehart/ to

learn more.