Jan 22, 2021

This Podcast Is Episode Number 403, And It's About Cash Flow Management And How To Track Income

A wise business owner once said, "Happiness is positive cash flow." As a business owner, I'm sure you agree. Everything is better when your cash-in exceeds your cash-out.

A cash crisis can be emotionally devastating, and it can even kill your business. If you've ever had to beg, borrow, and steal to cover tomorrow's payroll, you know what I mean.

Having a proper cash management system allows you to:

- Know when, where, and how your cash needs will occur.

- Know what the best sources are for meeting your additional cash needs.

- Be prepared to meet these needs when they occur by keeping good relationships with bankers and other creditors.

The starting point for avoiding a cash crisis is allowing your accountant to develop a cash flow projection for you. Your construction accountant can help you develop both short-term (weekly, monthly) cash flow projections, help you manage daily cash, and long-term (annual, 3-5 year) cash flow projections to help you develop the necessary capital strategy to meet your business needs.

Also, a well kept historical cash

flow statements help you understand where all the money went.

Having an accurate cash flow projection has several benefits and

will make many procedures easier for your construction company.

The one burning

question contractors want to know: When is it income?

When money comes into the business, at some point, it turns into income. "Money goes in and out of my business, and I don't understand when it is income and when it is not." Without proper tracking and matching of income and expenses, most construction companies never know if they made a profit until the job is over.

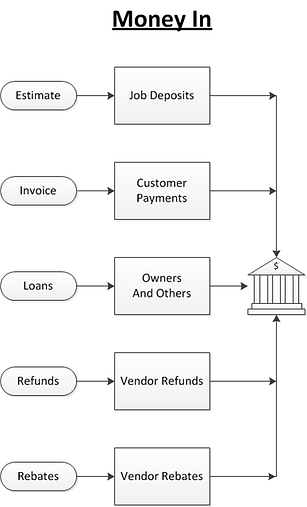

The Diagram Below Shows Five Ways Money Comes In

- Job Deposit - Customer signs a contract and gives the contractor a down payment check - (Not Income)

- Invoice - Contractor sends the customer an Invoice for the work done, and the customer pays - (Income)

- Loans - Contractor, outside investors, banks loan money to the business - (Not Income)

- Refunds - Contractor returns unused material, gets money back - (Not Income)

- Rebate - Contractor receives a rebate when buying a new truck

- (Not

Income)

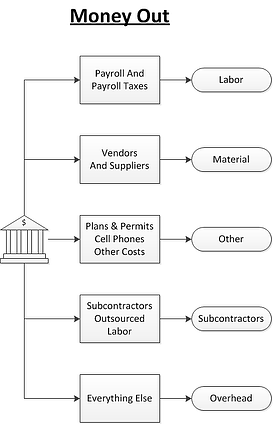

The Diagram Below Shows Five Ways Money Goes Out

- Labor - Payroll and taxes because contractors can make good money with qualified labor - (Not Income)

- Material - It takes money to make money, and you need material to build and repair things - (Not Income)

- Other - Costs you need to operate a mobile business like construction - (Not Income)

- Subcontractors - Do what you do best and outsource the rest - (Not Income)

- Overhead - Everything not directly related to fieldwork

- (Not

Income)

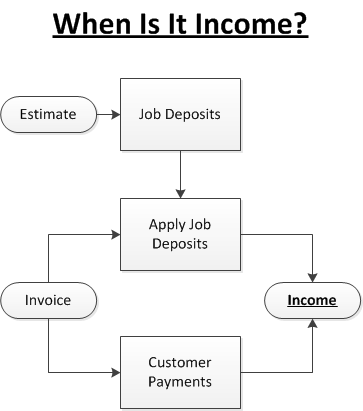

The Diagram Below Shows When It Is Income

- Invoice - The only time when money coming in is - (Income)

- Job Deposit - Applied to an Invoice, the money is - (Income)

- Customer

Payments -

Applied to a complex Invoice, it is - (Income)

Our services can provide you:

- Help in obtaining an appropriate line of credit

- Cash collection acceleration techniques

- Proven effective collection policies

- Established effective payment policies

- Help in getting the maximum rate of return on your idle cash

Final thoughts

About The Author:

![]() Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

1-800-361-1770 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business

Consulting And Accounting in Lynnwood, Washington. She is the

leading expert in managing outsourced construction bookkeeping and

accounting services companies and cash management accounting for

small construction companies across the USA. She encourages

Contractors and Construction Company Owners to stay current on

their tax obligations and offers insights on how to manage the

remaining cash flow to operate and grow their construction company

sales and profits so they can put more money in the bank. Call

1-800-361-1770 or sharie@fasteasyaccounting.com